Hi everyone. Are you trying to decide whether QuickBooks Online or QuickBooks Self Employed is right for you?

No worries, I’ll show you my expert comparison of QuickBooks Online vs QuickBooks Self Employed. I have updated this comparison with all of the latest features.

QuickBooks Online vs QuickBooks Self-Employed video

Here is the video:

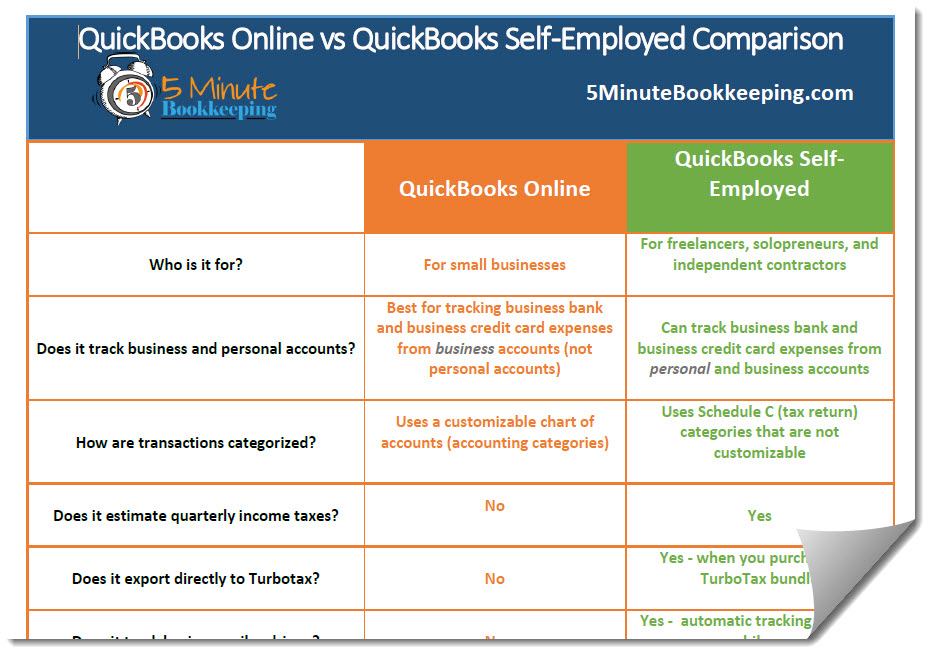

QuickBooks Online vs QuickBooks Self-Employed comparison chart

Here is a comparison chart I put together to show you the main features of each product and how they compare. Click to download the full QuickBooks Online vs QuickBooks Self Employed chart.

Click to download the full QuickBooks Online vs QuickBooks Self Employed chart.

Special discount: Get 50% off the monthly price for QuickBooks Self-Employed for the first 6 months

Who should use QuickBooks Online?

Small business owners who pay employees or contractors, who need to track accounts receivable, accounts payable, and view extensive reports about their business.

With QuickBooks Online – the goal is to manage the financial aspects of your business. You can get up to 65 built-in business reports. Here is a link showing all of the features of QuickBooks Online.

With QuickBooks Online, you can customize income and expense categories, you can customize the settings to your specific business needs, and you can integrate it with apps to add functionality.

A business with employees should use QuickBooks Online. Industry-specific businesses like a product-based business, medical, e-commerce, trade contractors, and restaurants should use QuickBooks Online.

Ready to buy QuickBooks Online? Buy QuickBooks Online here.

Who should use QuickBooks Self Employed?

[bctt tweet=”Should you be using #QuickBooks Self Employed? Get an insider’s comparison to #QuickBooks Online” username=”5MinBookkeeping”]

People who work for themselves can greatly benefit from QuickBooks Self Employed.. Like – freelancers, coaches, creatives, solopreneurs, mompreneurs, bloggers, social media strategists, and more. A good example would be Uber drivers, Upwork freelancers, independent salon owners, life and business coaches, independent massage therapists, personal trainers, creative freelancers, etc.

With QuickBooks Self Employed – the goal is to track freelance or solopreneur business income and expenses, capture all expense deductions for tax time, track business mileage, estimate quarterly tax payments, and make tax time really simple and easy.

Special discount: Get 50% off the monthly price for QuickBooks Self-Employed for the first 6 months

With QuickBooks Self Employed – you connect QBSE to your bank and credit card accounts and you categorize business income and expenses using “Schedule C” categories. That means that everything is categorized to make filing your taxes simpler. QBSE offers limited reporting capabilities – including a profit & loss report, and a Schedule C report.

With QuickBooks Self Employed you can snap pictures of receipts and categorize them using the mobile app. You can track mileage automatically and swipe on your phone to indicate whether it’s business or personal. You can also use it to estimate quarterly tax payments.

Perhaps the greatest feature of QuickBooks Self Employed is that it’s designed to simplify tax time. You most definitely do 5 Minute Bookkeeping with QuickBooks Self Employed – just work on your business finances once a day for 5 minutes a day!

Not sure yet?

If you plan to stay a freelancer, a solopreneur, or independent – use QuickBooks Self Employed.

If you want tax time to be very simple and easy and you are a freelancer, a solopreneur, or independent – use QuickBooks Self Employed.

If you plan to hire employees – use QuickBooks Online Simple Start or QuickBooks Online Essentials.

If you plan to grow your business in the near future – I recommend using QuickBooks Online Simple Start or QuickBooks Online Essentials.

FAQ’s

Can I convert from QuickBooks Self Employed to QuickBooks Online?

No, right now you cannot convert from QuickBooks Self Employed to QuickBooks Online.

I really like the mileage tracking feature in QuickBooks Self Employed. Does QuickBooks Online track business mileage?

No, right now QuickBooks Online does not track business mileage. Why not try a phone app to track your business mileage like MileIQ? I actually use QuickBooks Self Employed just to track my business mileage.

I’m a freelancer and I track billable hours and invoice clients for my time? Which product should I use?

You can QuickBooks Online so you can enter billable hours and invoice them. Right now QuickBooks Self Employed does not track billable hours (however, you can create invoices in QuickBooks Self Employed).

Can I invoice customers with QuickBooks Self Employed?

Yes, you can. You can get paid online by connecting QBSE to QuickBooks Payments. QBSE does not currently automate the accounts receivable process (to see which customers owe you money). You have to manually mark an invoice as “paid” in QBSE.

What if I plan to hire employees in the future?

You should use QuickBooks Online. QuickBooks Self Employed does not include a payroll feature.

Does QuickBooks Self Employed track sales tax?

No, QuickBooks Self Employed does not track sales tax. QuickBooks Online tracks sales tax.

How can I test drive QuickBooks Online or QuickBooks Self Employed?

You can test drive a sample QuickBooks Online company here. Just enter the security verification.

To test drive QuickBooks Self Employed here. You can also sign up for a free trial here.

What is a Schedule C?

It is an IRS form that most self-employed people file to report their business income and expenses to the IRS. With QuickBooks Self Employed, you categorize income and expenses according to categories on Schedule C.

What if I am using QuickBooks Online, can I convert to QuickBooks Self Employed?

There is not a way to convert from QuickBooks Online to QuickBooks Self Employed. If QuickBooks Online is a better fit for your business, then wait until the beginning of the calendar year and start using QuickBooks Online as of the first of January.

Closing

I hope that my comparison of QuickBooks Online vs QuickBooks Self Employed has given you more confidence in choosing the right product for your personal situation. Do me a favor, will you share this post on social media? This would really help me and I’m sure there are others who are confused about which product to choose.

[Note: This post contains affiliate links]

Thank you for the excellent article

Hi Veronica

I started using quick books self employed and I really got on with it until I discovered you can’t change the dates of your accounting year with the software. My accounting dates run from 31st may to 1st june. Could you recommend some software I can use on the go with my iPhone?

I am a musician and so I have to keep track of all of the lessons I have taught throughout the day, gig payments, invoices and expenses whilst staying away from home.

Many thanks

Kind regards

Alex

Hi. You could use QuickBooks Online – you will be able to set a fiscal year. If you do use QBO, be sure to get all the free tutorials directly from our blog. QuickBooks Online also has a mobile app that you can use with your iPhone. I suggest that you start with QuickBooks Online Simple Start.

looking everywhere for help.

i have quickbooks self employed in the uk but i cant invite my accountant.

Can you help please

Hi Robert,

Definitely ask this question in our Facebook community. They are very good at troubleshooting issues for other QuickBooks users. https://www.facebook.com/groups/5minutebookkeeping/