In this blog post, we are checking back in with Joe. After reading Parts 1 & 2 of our blog series on PayPal, Joe has his PayPal account linked to his Checking account and is paying vendors through PayPal AND receiving payments from customers through PayPal. But now, Joe has a major problem on his hands. Customer payments and vendor expenses are now commingled in his PayPal account, and Joe is having a hard time making sense of everything. Even more confusing is when a vendor payment shows up as one amount on Joe’s monthly PayPal statement, but then the very same vendor payment shows up as a different amount on Joe’s monthly bank statement. Joe just doesn’t understand what’s happening, and its making him nervous. Joe is desperate for a workflow because, obviously, PayPal has a mind of its own. If you are also paying vendors in PayPal and receiving customer payments, you may have run into the same confusion as Joe. For some clarity, keep reading this final segment of our blog post series on PayPal: How to link PayPal to QuickBooks Online [Part 3].

First, let’s quickly review what I have covered so far in Parts 1 and 2. I mentioned that PayPal was a facilitator for online payments and that there were 4 primary ways to use PayPal:

- Make payments to vendors using a credit card as the primary PayPal account.

- Make payments to vendors using a checking account as the primary PayPal account.

- Use PayPal to receive customer payments.

- Use PayPal to receive customer payments and make payments to vendors.

This blog post covers how to use PayPal to both pay vendors and receive customer payments, and how to record these transactions in QuickBooks Online.

What happens when you use PayPal to pay vendors AND receive customer payments?

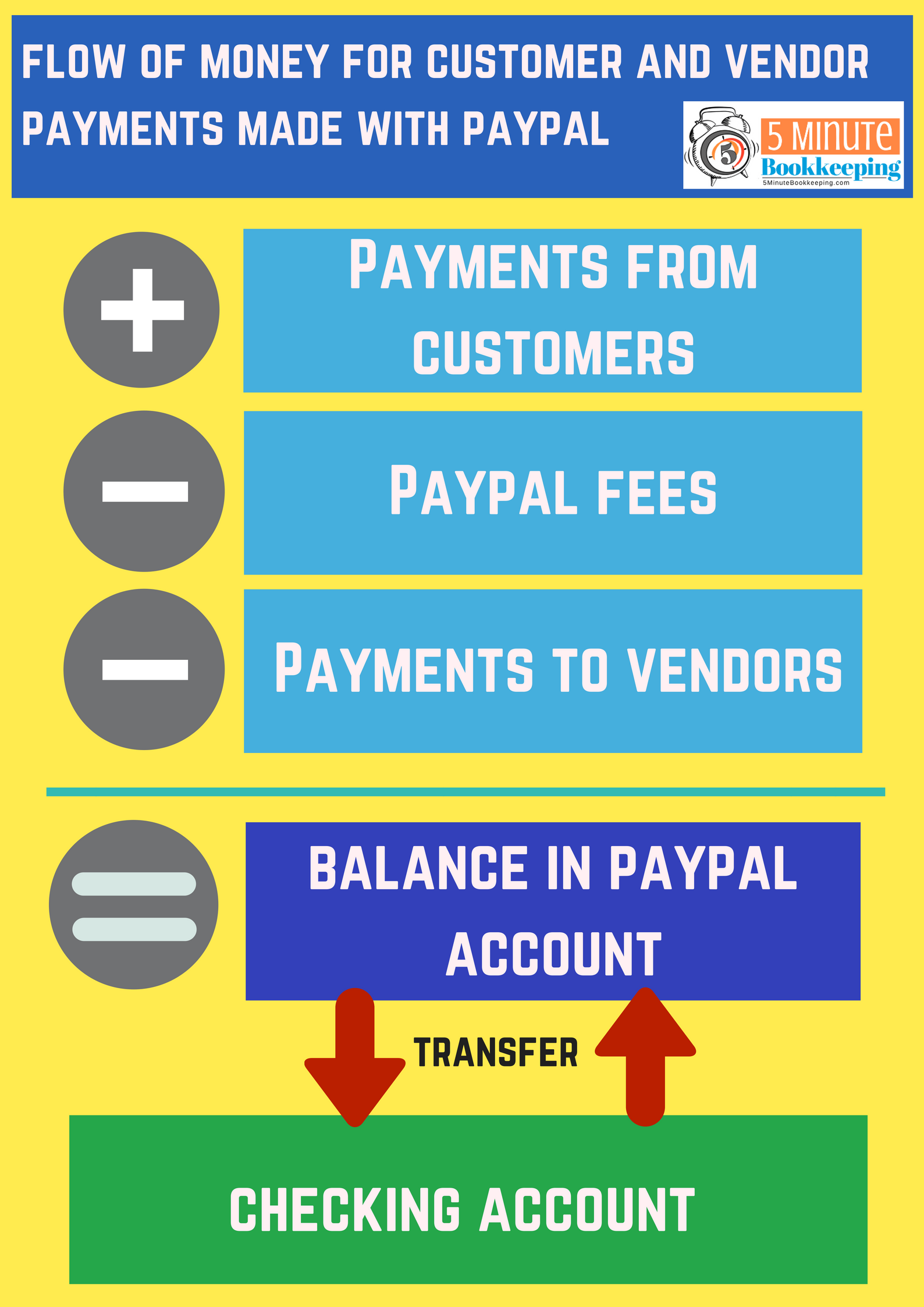

Here’s a diagram showing you the flow of money for customer payments received and payments to vendors made with PayPal.

When you use PayPal to pay vendors and receive customer payments, you may run into one of two scenarios:

PayPal Scenario #1

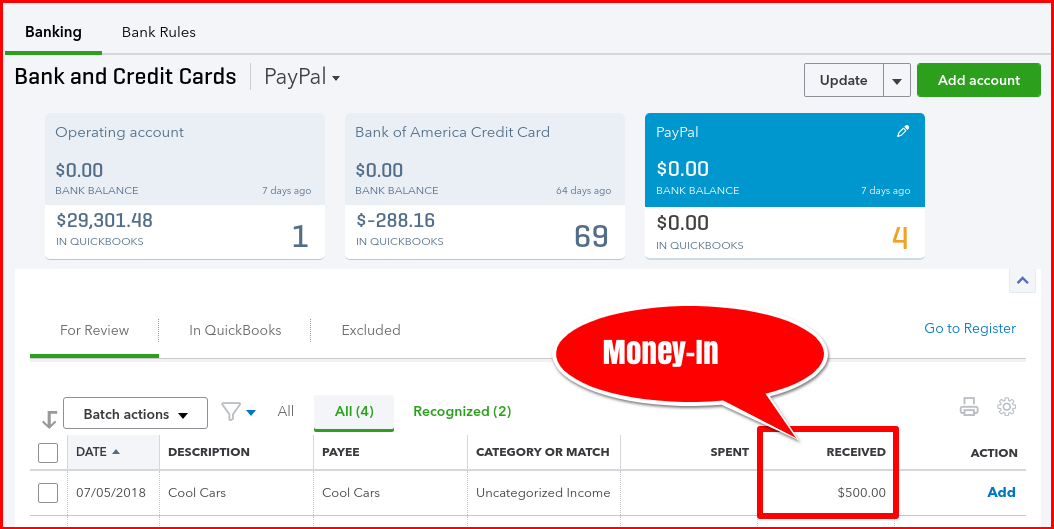

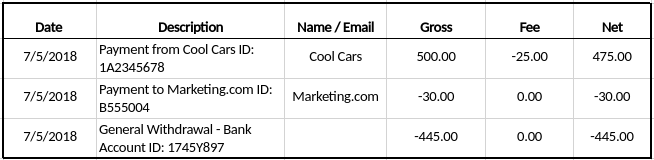

Let say, you received a $500 customer payment through PayPal. You would then see a $500 money-in transaction in your PayPal bank feed.

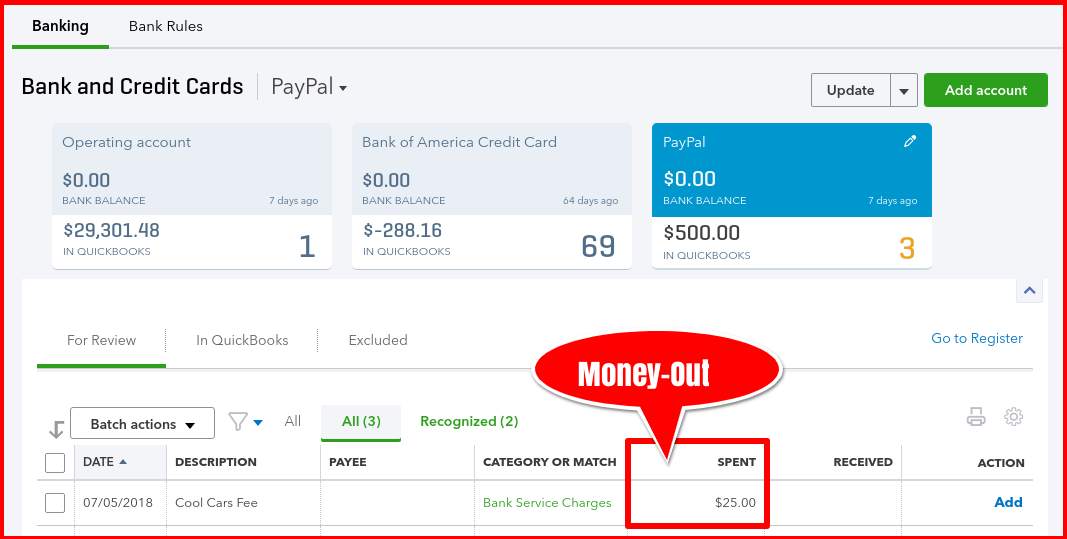

The $500 customer payment was then reduced by a $25 PayPal service charge, leaving you with a net balance of $475 in your PayPal account. As a result, you will also see a $25 money-out transaction for the service charge in your PayPal bank feed.

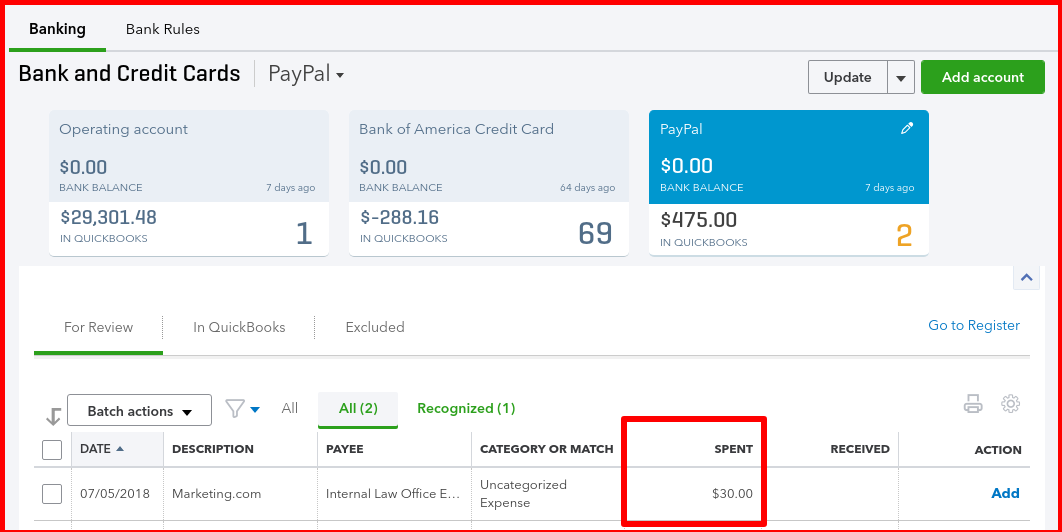

Then, you make a $30 payment to a vendor, using your PayPal account. Your PayPal balance has now been reduced to $445, as PayPal will deduct vendor payments from the balance in your PayPal account before drawing funds from your bank account or credit card account. When you pay a vendor, you will see a money-out (expense) transaction for $30 in your PayPal bank feed.

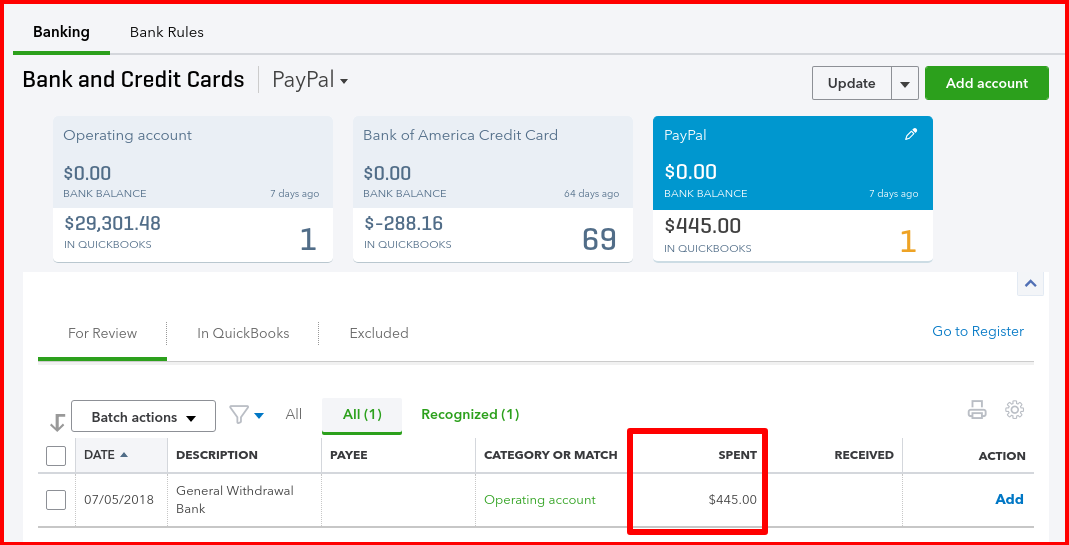

When you finally decide to transfer the PayPal balance to your checking account, you will only have $445 available since the money you earned from the $500 customer payment has been reduced by a service charge and a vendor payment. When you transfer money from your PayPal account to your Checking account, you will see a money-out transaction in your PayPal bank feed for the transferred amount.

Here is a sample PayPal statement with a customer payment, a service charge, and a transfer of funds to the Checking account.

PayPal Scenario #2

Let say, you received a $500 customer payment through PayPal. Again, you would then see a money-in transaction in your PayPal bank feed.

Because each customer payment is followed by a service charge, you will again see the $25 money-out transaction in your PayPal bank feed, leaving you with a net balance of $475 in your PayPal account.

Now, here’s where it gets different.

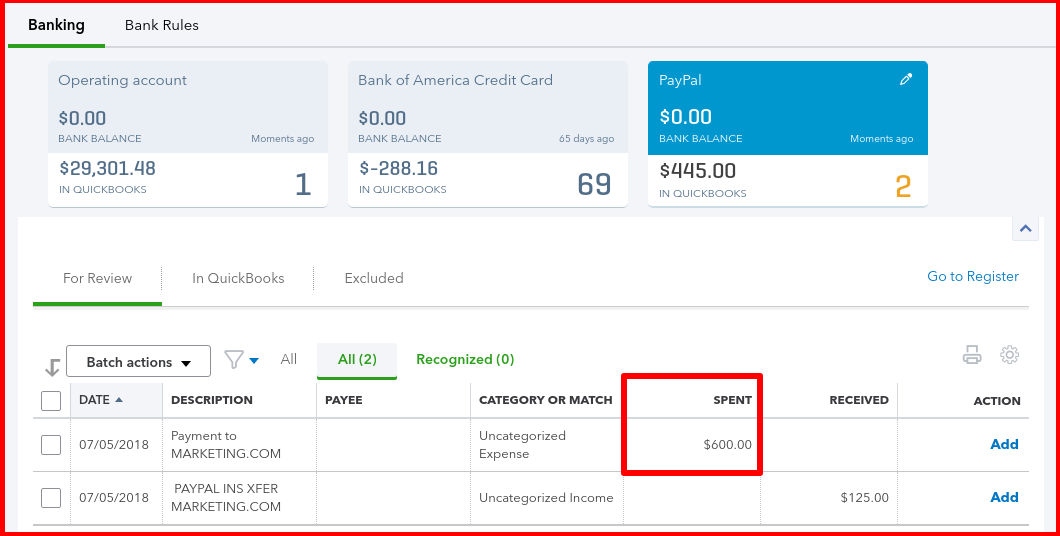

You then make a $600 payment to a vendor, using your PayPal account, so you will see a $600 money-out transaction in your PayPal bank feed.

But wait! You only have $475 in your PayPal account. No problem. When your PayPal account is linked to your Checking or Credit Card account, here is what will happen: First, the $600 vendor payment will be applied to the existing $475 balance in your PayPal account. PayPal will withdraw funds from the bank or credit card account which is connected to your PayPal account. As a result, you will see a $125 money-in transaction in your PayPal bank feed.

Here is a sample PayPal statement with a customer payment, a service charge, and a transfer of funds to the Checking account.

Connect your PayPal Account to QuickBooks Online

Before recording PayPal customer payment in QBO, make sure that your PayPal account is set up and connected in QBO.

Click here to learn how to properly connect your PayPal account to QuickBooks Online.

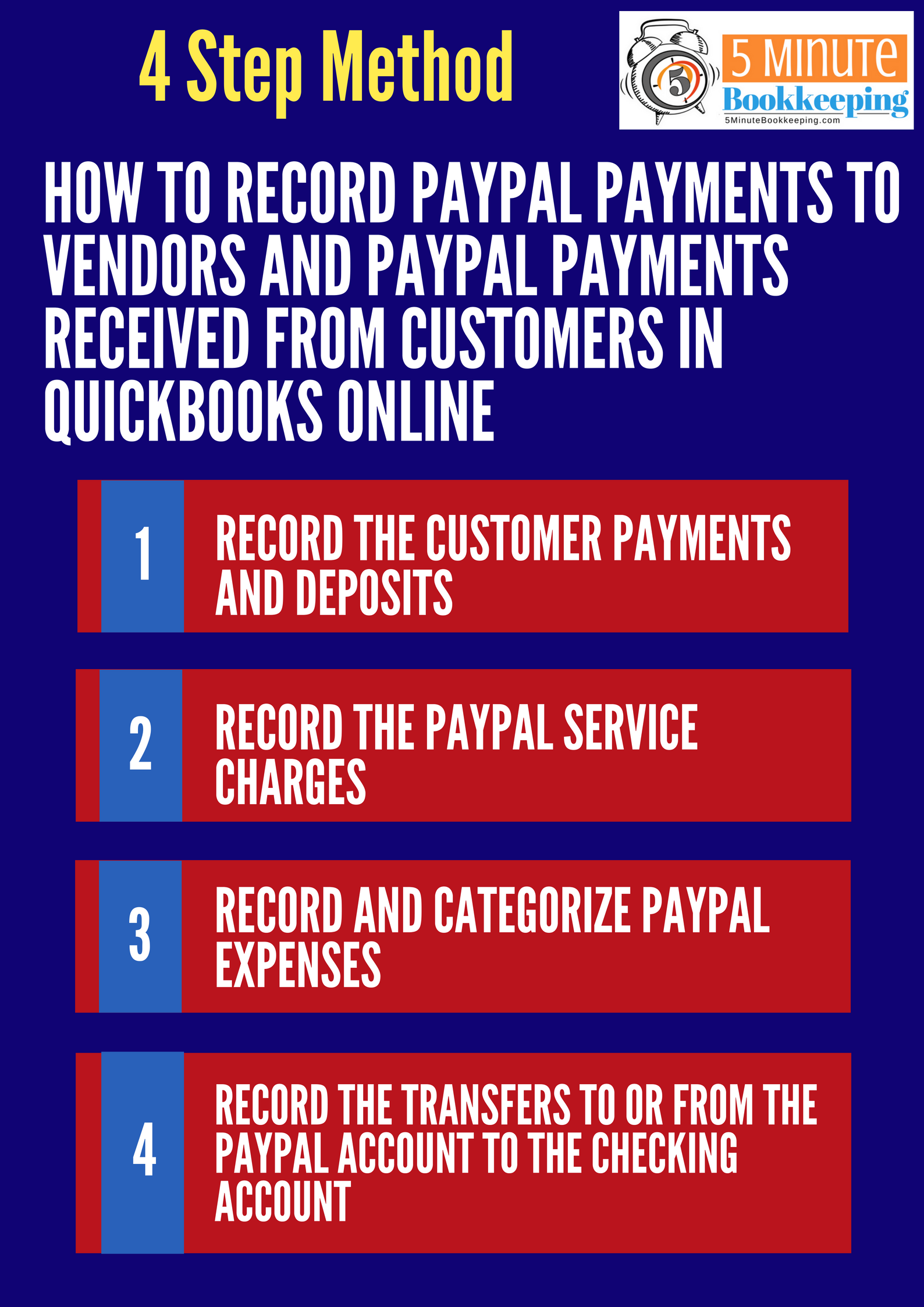

4 Step Method for recording PayPal transactions in QuickBooks Online

Record the customer payments and deposits

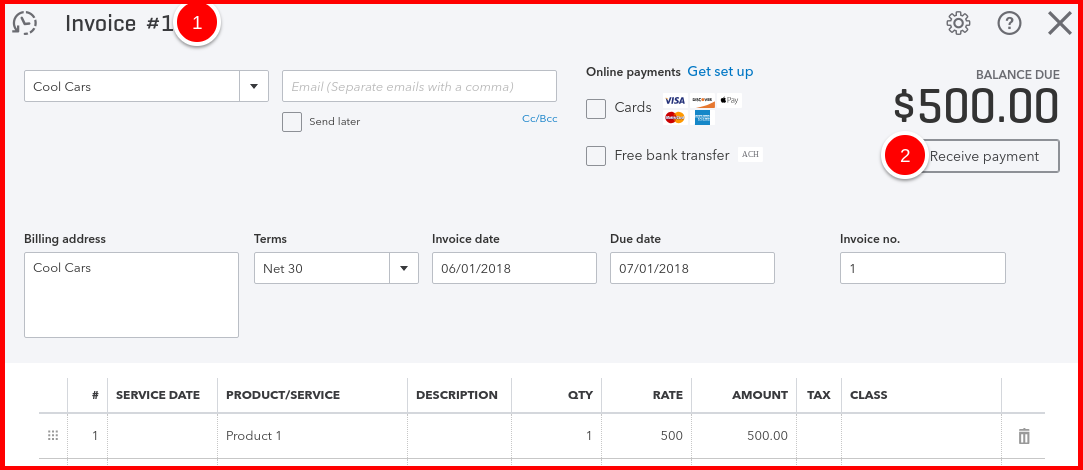

- Find and open an unpaid customer invoice(s).

- For each invoice, select Receive Payment.

The Receive Payment window will open.

- Under Payment date, enter the date of the customer payment.

- For Payment method, select PayPal.

- Under Deposit to, select Undeposited Funds.

- Select Save and New or Save and close to finish recording the customer payment.

Follow these steps for each invoice payment received through PayPal.

Next, open the Bank Deposit window.

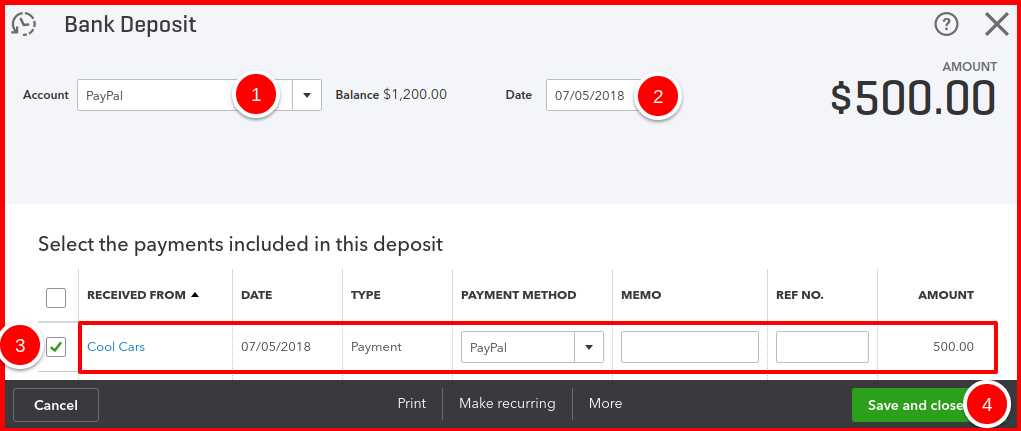

In the Bank Deposit window:

- Under Account, select PayPal.

- Enter the Date of the customer payment.

- Select the PayPal customer payment.

- Select Save and New OR Save and Close.

Make sure that you record a separate deposit for each customer payments received through PayPal.

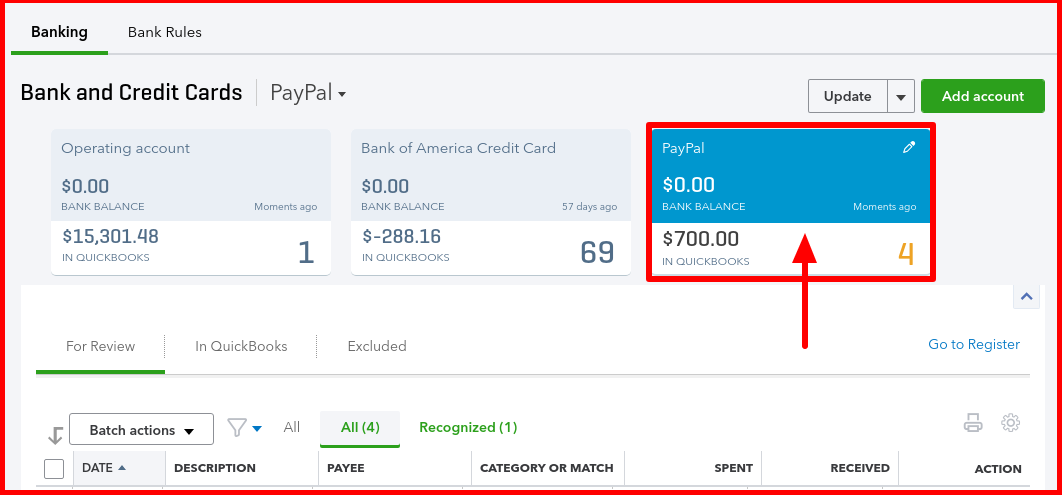

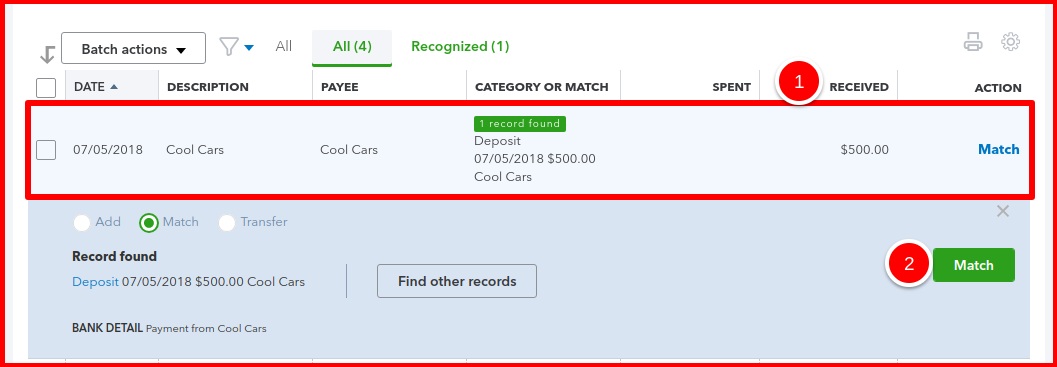

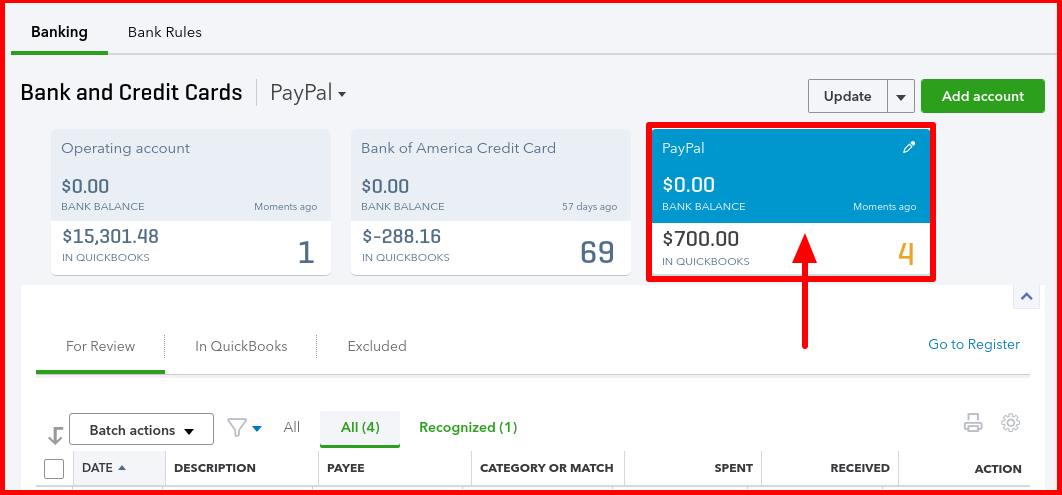

Now that you have recorded the deposit, go to the QBO Online Banking (Bank Feeds) section and select the PayPal account.

- In the Received column, locate the deposit which was just recorded.

- Select Match.

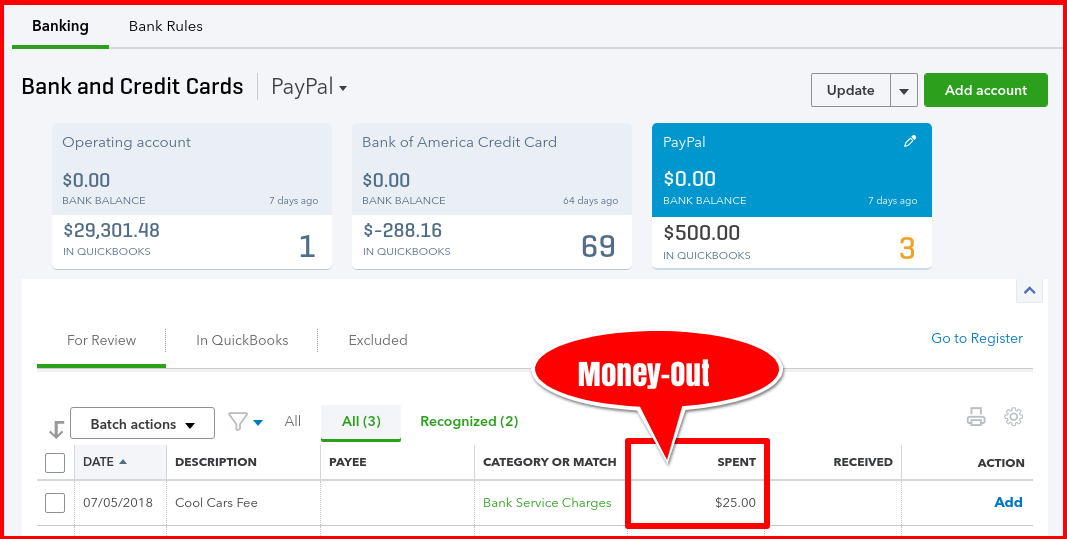

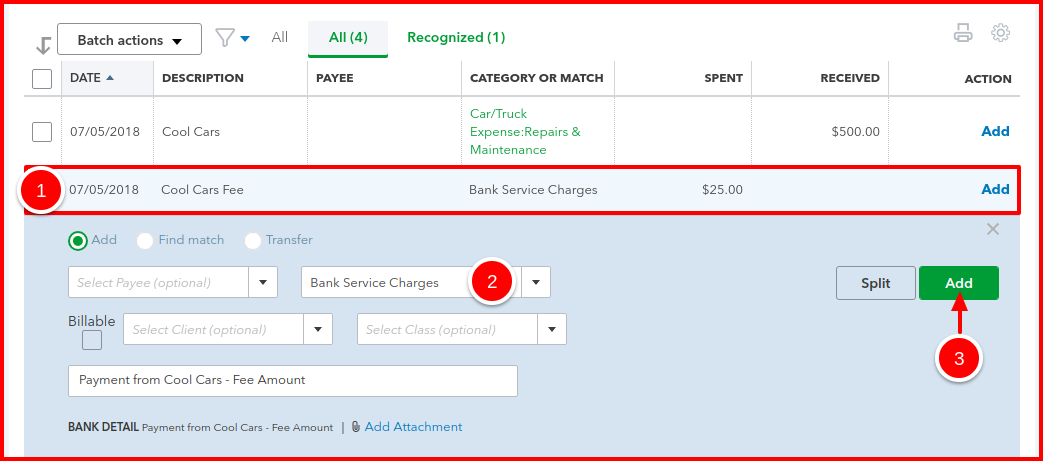

Record the PayPal service charges

Now, add the PayPal service charges to QBO.

To enter the PayPal fee, go to the QBO Online Banking (Bank Feeds) section and select the PayPal account.

- Look in the Spent column and locate the service charge. It will be on the exact same date as the customer payment.

- Select an account such as Bank Fees or Bank Service Charge.

- Select Add.

Record and categorize the PayPal expenses

To enter a money-out (expense) transactions, go to the QBO Online Banking (Bank Feeds) section and select the PayPal account.

Example:

- Select the $600 money-out transaction for Marketing.com, dated 7/5/2018.

- Assign the appropriate vendor.

- Assign the category.

- Select add.

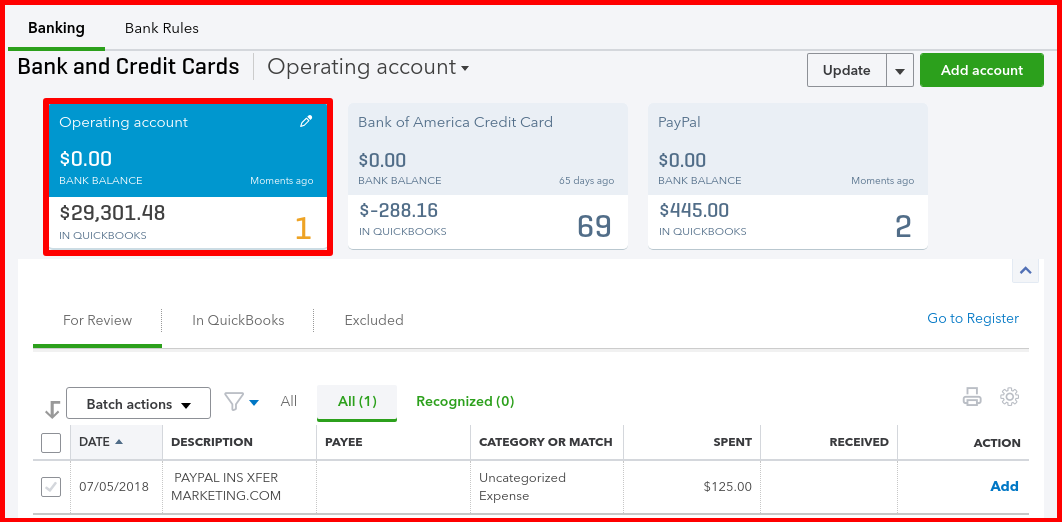

Record the transfer between the PayPal account and the Checking account

Note: Before recording this transfer in QBO, be sure that you have actually made a transfer in your PayPal account to your Checking account. Otherwise, you will not see the transfer in Online Banking section.

Since the $600 expense was more than the $475 balance in PayPal, we need to record a transfer from the Checking account to the PayPal account.

To record the transfer, go to the QBO Online Banking (Bank Feeds) section and select the Checking account.

- Locate the transfer in the Spent column (It will be a money-out transaction).

- The transfer should have a memo.

- Check the circle next to Transfer.

- Select the Checking account as the account you will be transferring to.

- Finally, select Transfer.

Hang tight, you’re almost there. All you need to do now is match the transfer in the Checking account.

- Go to the Online Banking (Bank Feeds) section and select the PayPal account.

- Locate the transfer from the Checking account to the PayPal account which was just recorded.

- Finally, select Match.

Always, reconcile your PayPal account

Whether you’re using PayPal to receive customer payments or pay vendors, it’s important to reconcile your PayPal account at the end of every month. However, reconciling your PayPal account is even more important when using PayPal to receive customer payments and pay vendors, because, at this point, your PayPal account is just like a fully-fledged bank account.

[bctt tweet=”Whether you’re using PayPal to receive customer payments or pay vendors, it’s important to reconcile your PayPal account at the end of every month.” username=”5MinBookkeeping”]

Here’s a video instruction, showing you how to reconcile a bank account.

Closing: How to link PayPal to QuickBooks Online

Whew! We have finally reached the end of our 3-part series on PayPal: How to link PayPal to QuickBooks Online, where I showed you how to record PayPal payments to vendors and payments received from customers in QuickBooks Online. Whether your business uses PayPal to pay vendors, receive payments from customers, or BOTH, this series has shown you how to correctly record those payments in QuickBooks Online. Now it’s your turn to dive into your PayPal transactions in QuickBooks Online and record them with confidence! Just a final tip, you may want to save the link to this blog post to your favorites to reference for those times when things get a little confusing in your PayPal account (We’ve all been there).