Joe’s business was growing rapidly, and his customers were asking him if they could pay him though PayPal. It sounded like a good idea, but Joe didn’t know what to do. After all, he was not too familiar with PayPal. Furthermore, Joe didn’t know how to enter customer payments made with PayPal in QuickBooks Online. Fortunately, in this blog post, I’ll show you how to record PayPal customer payments. Keep reading for part 2, of our new blog post series on PayPal: How to link PayPal to QuickBooks Online.

How PayPal works

In a previous blog post, I mentioned that PayPal was a facilitator for online payments. I also mentioned that there were 4 primary ways to use PayPal:

- Make payments to vendors using a credit card as the primary PayPal account.

- Make payments to vendors using a checking account as the primary PayPal account.

- Use PayPal to receive customer payments.

- Use PayPal to receive customer payments and make payments to vendors.

This blog post covers how to use PayPal to receive only customer payments and not paying any expenses out of PayPal.

When you’re using PayPal to receive customer payments, PayPal works like a separate bank account. When a customer pays you, money is transferred from the customer to your PayPal account. These funds will then remain in your PayPal account until you initiate a transfer. The transfer will then move the funds from your PayPal account into your Checking account.

Here’s a diagram, showing you the flow of money from a customer payment made with PayPal.

When a customer payment is received, PayPal also assesses a service charge. This service charge is deducted from the gross amount of your customer payment.

Also, if you decide to use PayPal to receive customer payments, be aware that you can only link PayPal with your Checking account, because you can’t receive credits into your Credit Card account.

CONNECT YOUR PAYPAL ACCOUNT TO QUICKBOOKS ONLINE

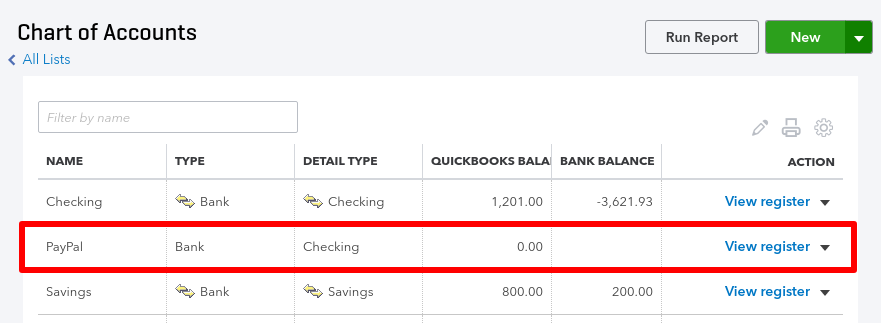

Before recording PayPal customer payment in QBO, make sure that your PayPal account is set up and connected in QBO.

Next, connect your PayPal account to QBO. In the online banking section, select Add Account.

Next, select PayPal.

Select Let’s do it to begin connecting to PayPal

Select Give permission and follow the remaining steps to complete the PayPal setup in QBO.

WORKING WITH YOUR PAYPAL ACCOUNT IN QUICKBOOKS ONLINE

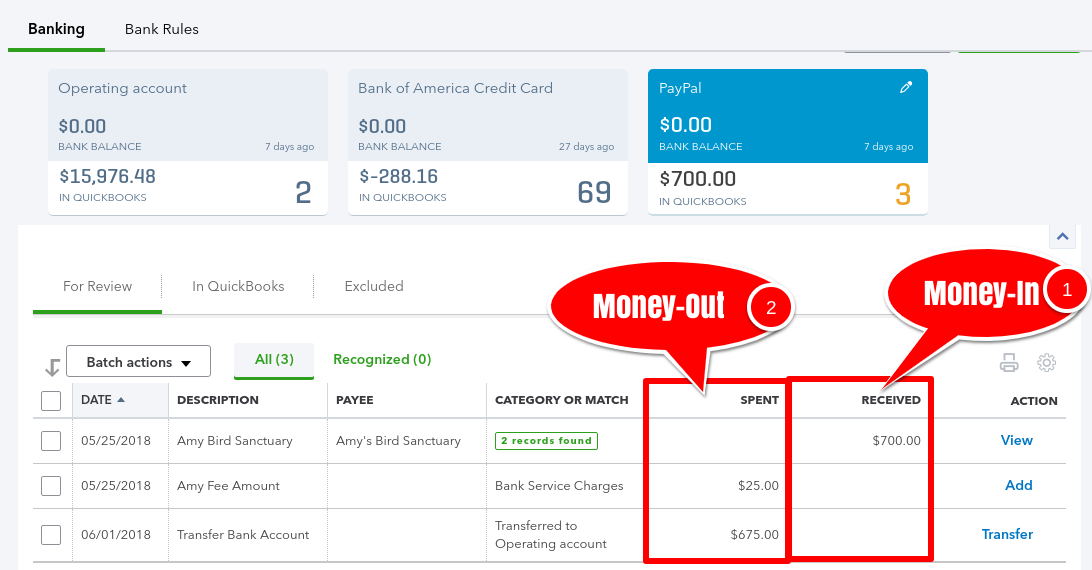

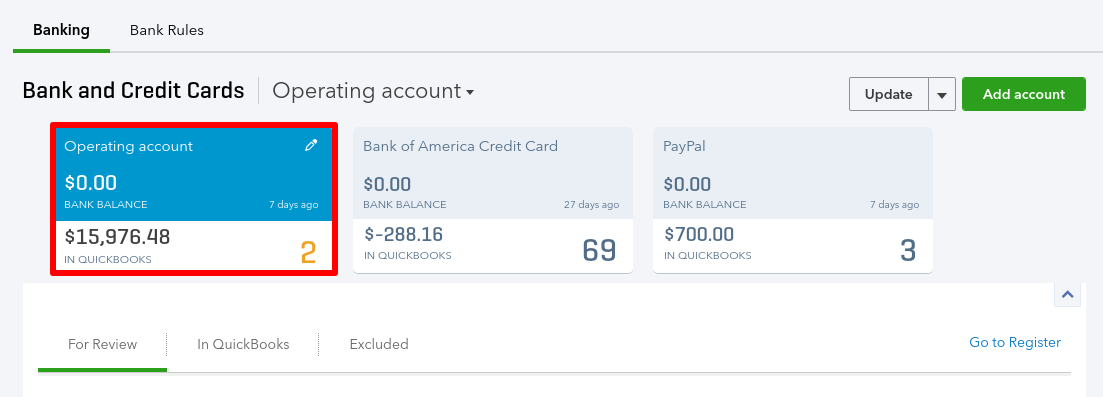

Once your PayPal account is connected to QBO, you will see “money-in” and “money-out” transactions in the Online Banking (Bank Feeds) section.

- The money-in transactions are the actual customer payments. They are found in the RECEIVED column.

- The money-out transactions are the PayPal service charges and transfers from the PayPal account to the Checking account. They are found in the SPENT column.

Let’s go through the PayPal workflow in QuickBooks Online:

If you invoice a customer for $700 and receive the customer payment with PayPal, then PayPal will assess a $25 service charge. As a result:

- You will see a $700 money-in transaction.

- You will also see a $25 money-out transaction for the service charge.

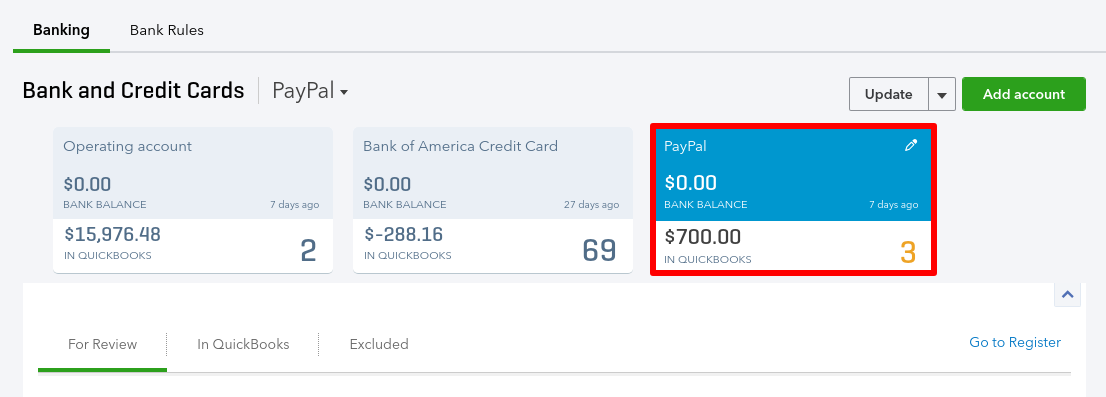

When you receive a customer payment, the money is first deposited into your PayPal account. That means your PayPal account now has a balance.

You can then transfer the money you received from your PayPal account into your regular Checking account. When you transfer money from your PayPal account to your Checking account, you will see a money-out transaction for the transferred amount.

Depending on when or whether you transferred money from your PayPal account to your checking account, you could have an ending balance on your month-end PayPal statement.

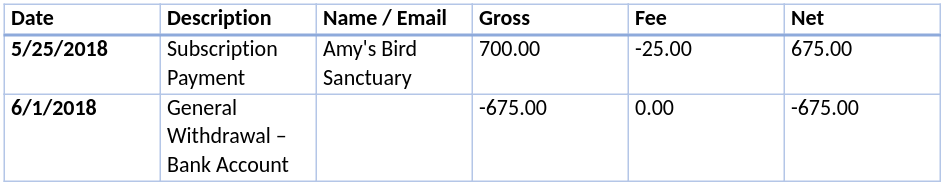

Here is a sample PayPal statement with a customer payment, a service charge, and a transfer of funds to the Checking account.

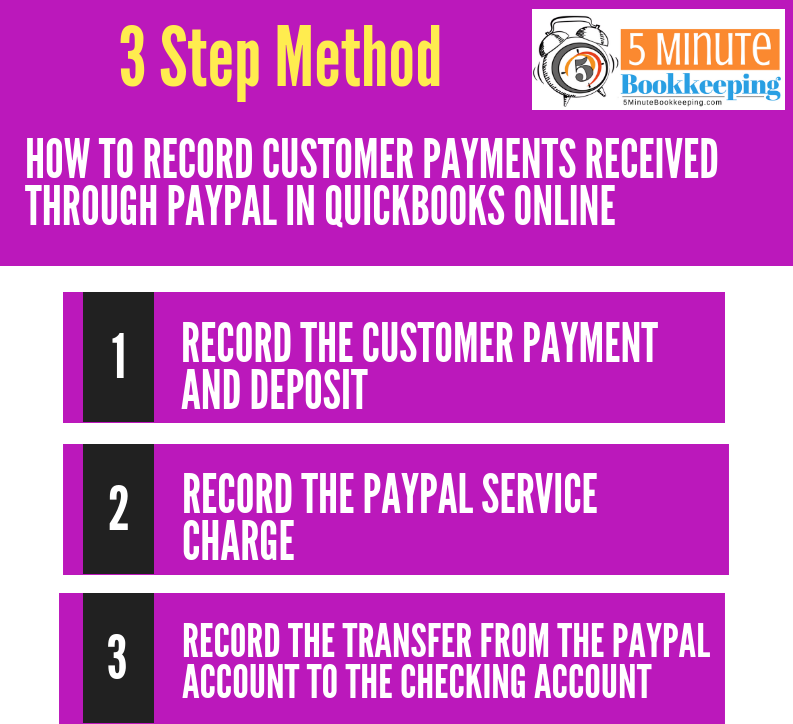

In the next section, I’m going to show you the 3-step method for correctly recording customer payments received through PayPal.

#1 – Record the customer payment and deposit in QBO

Just as a reminder: This blog post covers how to use PayPal to receive only customer payments and not paying any expenses out of PayPal. If you’re using PayPal to receive customer payments and pay vendors, we will have a separate blog post on that topic.

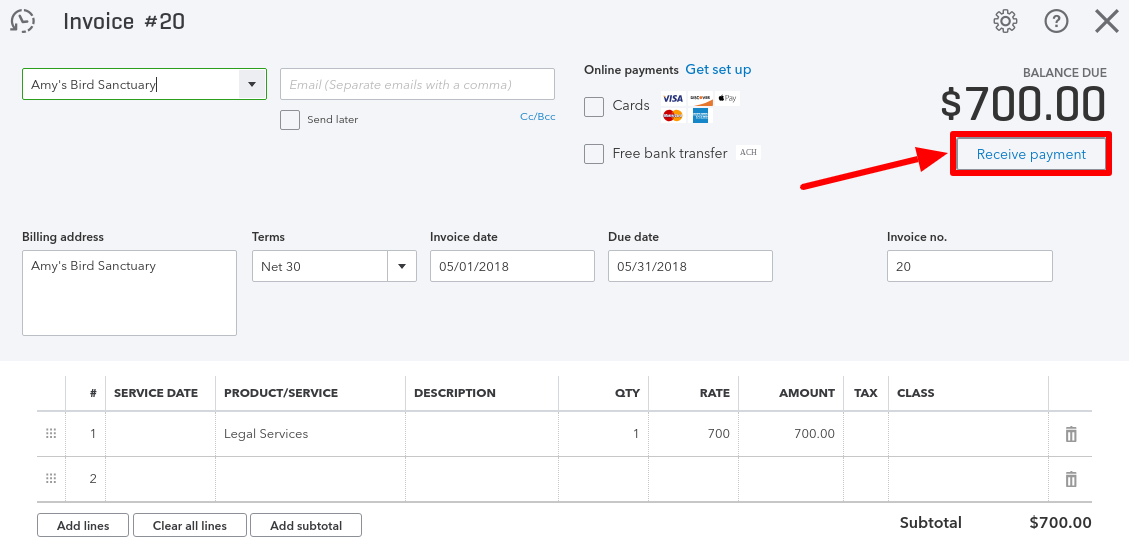

Find and open the unpaid customer invoice(s).

For each invoice, select Receive Payment.

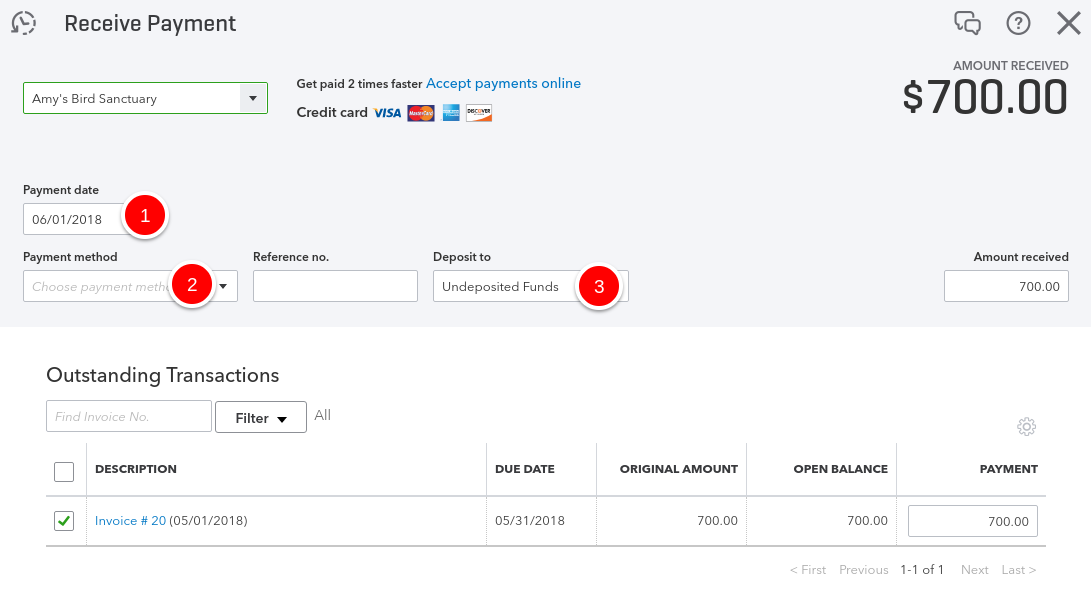

The Receive Payment window will open.

- Under Payment date, enter the date of the customer payment.

- For Payment method, select PayPal.

- Under Deposit to, select Undeposited Funds.

Follow these steps for each invoice payment received through PayPal.

Next, open the Bank Deposit window.

In the Bank Deposit window:

- Under Account, select PayPal.

- Enter the Date of the customer payment.

- Select the PayPal customer payment.

- Select Save and New OR Save and Close.

Make sure that you record a separate deposit for each customer payments received through PayPal.

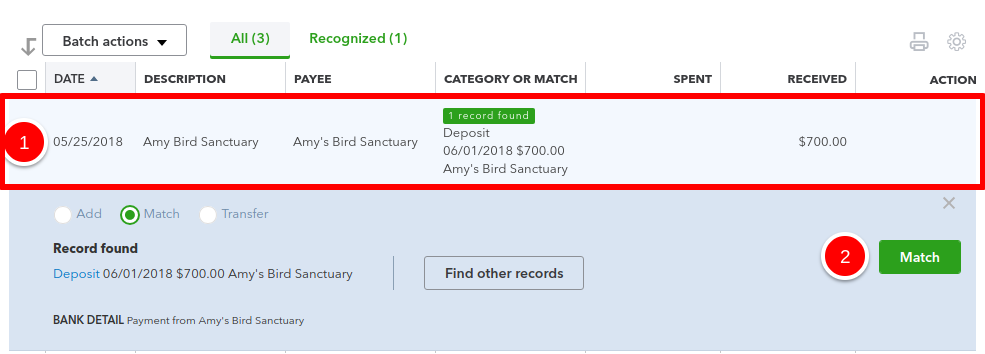

Now that you have recorded the deposit, go to the QBO Online Banking (Bank Feeds) section and select the PayPal account.

- In the Received column, locate the deposit which was just recorded.

- Select match.

#2 – Record the PayPal service charge

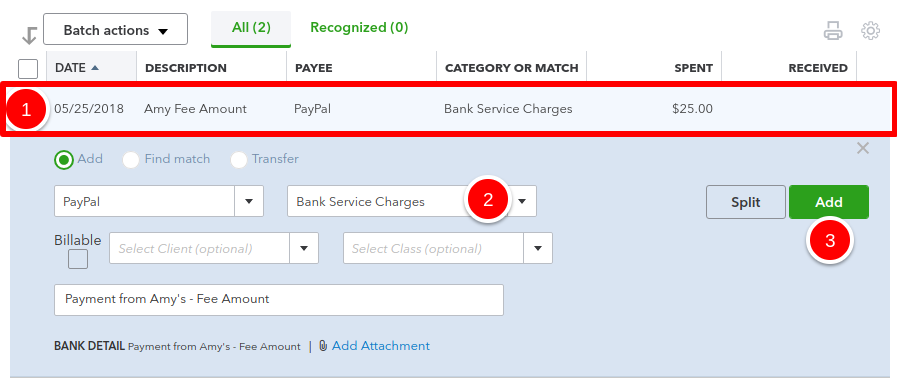

To enter the PayPal fee:

- Look in the Spent column and locate the service charge. It will be on the exact same date as the customer payment.

- Select an account such as Bank Fees or Bank Service Charge.

- Select Add.

#3 – Record the transfer from the PayPal account to the Checking account

Now you need to record the transfer from the PayPal account to the Checking account.

Note: Before recording this transfer in QBO, be sure that you have actually made a transfer in your PayPal account to your Checking account. Otherwise, you will not see the transfer in Online Banking section.

To record the transfer:

- Locate the transfer in the Spent column (It will be a money-out transaction).

- Check the circle next to Transfer.

- Select the Checking account as the account you will be transferring to.

- Finally, select Transfer.

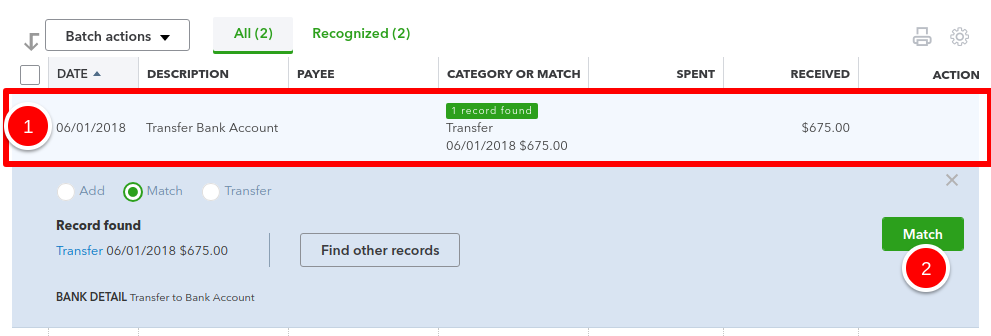

Hang tight, you’re almost there. All you need to do now is match the transfer in the Checking account.

Go to the Online Banking (Bank Feeds) section and select the Checking account

- Look for the money-in transaction representing the transfer.

- Since the transfer has already been recorded, simply select Match.

And there you have it. You now know how to record a PayPal customer payment in QuickBooks Online.

Finally, remember to reconcile

Whether you’re using PayPal to receive customer payments or pay vendors, you must always reconcile your PayPal account as if it were a regular Checking account.

Reconciling your PayPal account is especially important when you are using PayPal to receive customer payments because your PayPal account may have an ending balance at the end of the month.

Here’s a video instruction, showing you how to reconcile a bank account.

[bctt tweet=”Reconciling your PayPal account is especially important when you are using PayPal because your PayPal account may have an ending balance at the end of the month.” username=”5MinBookkeeping”]

Closing

This has been part 2 of our multi-part blog post series on PayPal: How to link PayPal to QuickBooks Online, where I showed you how to record customer payments made through PayPal. Of course, there are multiple ways to integrate you PayPal account in QuickBooks Online. In a previous blog post, I showed you to use PayPal to pay vendors. However, PayPal can also be used to pay vendors AND receive payment from customers, and it’s a topic which will be discussed in a future blog post. Stay tuned.