In my opinion, the greatest feature of QuickBooks is that you can easily change and edit transactions after you have saved them. It’s so easy to fix your mistakes. Unfortunately, the ability to make changes after the fact can have dire consequences. Most untrained users at some point have inadvertently changed or deleted transactions and then found that their reconciliations are out of balance. I’ll show you how to close the books in QuickBooks Online so that you can prevent inadvertent changes to your financial data.

What does it mean to “close the books”?

Long time ago, in a galaxy far far away…actually, back in the days before computers, accountants used to track financial transactions in really big books. When they finished working on the month’s transactions, they “closed the books” – meaning they were finished working on those books and could open new books for the next month.

Thankfully, we don’t have to do any bookkeeping using paper books! Closing the books in QuickBooks means setting up a password to prevent you or your employees from accidentally making changes to transactions in QuickBooks.

Why should I close my books in QuickBooks Online?

The primary purpose of closing the books is to preserve the integrity of your transactions and financial reports.

Scenario #1 – you enter transactions in QuickBooks for the month and reconcile them. You run reports based on the transactions you entered and you use these reports to make decisions for your business based on those reports. A couple of weeks later, you accidentally change transactions and now the reports look different – you can no longer rely on the reports because they have changed.

Scenario #2 – your tax accountant prepares your tax returns based on the transactions recorded in QuickBooks. Unfortunately, you accidentally changed several transactions after your tax accountant started the tax return. Your tax accountant doesn’t know that you made changes to your books. Now the reports in QuickBooks are not the same reports that you gave to your tax accountant. Your tax return could be wrong because you gave your tax accountant incorrect reports. These and other scenarios are why it’s important to close the books in QuickBooks.

A simple step like closing the books, will lock the data, preventing changes from being made before a specific date.

How to close the books in QuickBooks Online – video tutorial

Here is the video tutorial:

How to close the books in QuickBooks Online – STEP BY STEP

Our team member, Andrei Gololobov, will show you how to close the books in QuickBooks Online so that you can prevent accidental mistakes from happening.

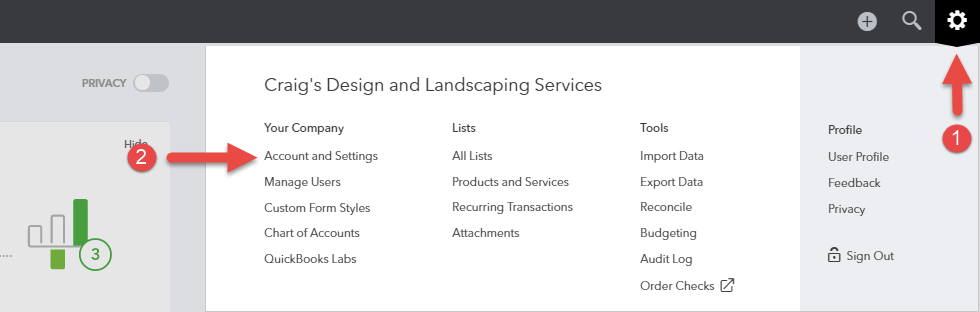

STEP 1

- Select the Gear Icon in the upper right hand corner of the screen

- Select Account and Settings

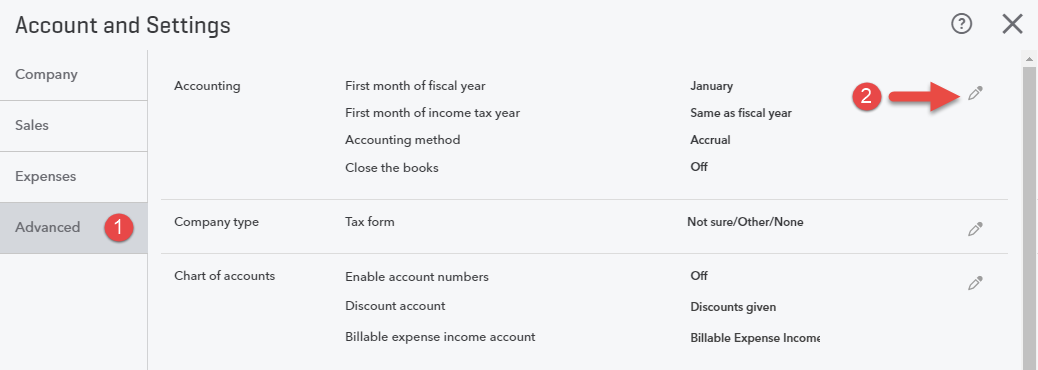

STEP 2

- From the left-hand menu bar, select Advanced

- Under Accounting, click the pencil icon

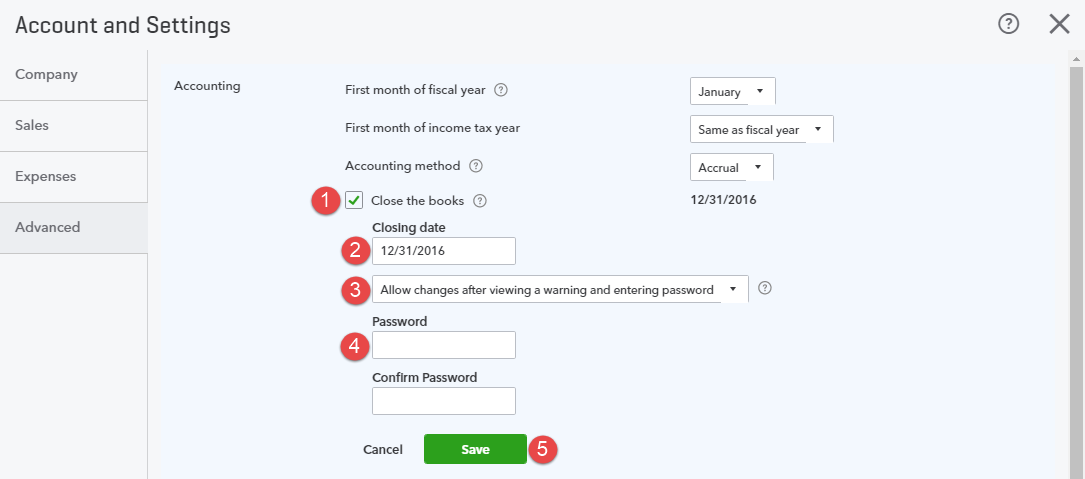

STEP 3

- Check the box next to Close the books.

- Enter the closing date. This can be the last date of the month or year. We recommend closing the books monthly.

- You will then have two options

- Allow changes after viewing a warning.

- Allow changes after viewing a warning and entering password. This option is recommended since it adds a layer of checks and balances. The added protection of a password can prevent you or your staff from mistakenly making changes to a transaction from a closed accounting period.

- Enter and confirm a closing password. Make sure you keep a record of the closing password. Remember to keep this password confidential – don’t share it with your staff.

- Select Save.

When should I close the books?

You should close the books after you have done the following:

- Reconcile QuickBooks to your bank and credit card statements. See my blog post “Why the 90’s called and they don’t want their bank reconciliation back”.

- Reviewed key reports and made any corrections. See my blog post “Review transactions in QuickBooks Online”.

I recommend closing the books annually at the very least. Ideally, you should be closing the books monthly.

Can I make changes to QuickBooks after I have closed the books?

In a perfect world, changes should never be made to closed books. That’s because you want to preserve the integrity of your financial data in QuickBooks.

If you forgot to enter a transaction or you need to make a change to a transaction in a closed period, you will need to enter the closing password you set up earlier.

What if I need to change something after I have closed the books?

Keep these best practices in mind:

- Consult your tax accountant if you need to change transactions to a prior year after a tax return has been filed.

- In many cases, you should be adjusting a transaction in the current period (current period is accountant talk for “today” or “this month” – a period that hasn’t been closed yet). For example, instead of deleting an invoice – you should issue a credit memo in the current period. Another example would be – instead of deleting a check, a check should be voided in the current period.

- In some cases, a change to a closed period is needed. If so, You should make the change and not share the closing password with your employees.

Should I share the closing password with my employees?

No, you should not. That would defeat the whole purpose of keeping others from making changes to closed periods.

Do I need to do anything else to close the books in QuickBooks Online?

No, that’s all you need to do. At year end, QuickBooks automatically closes out retained earnings and does other things in the background. You don’t have to worry about it.

It’s your turn to close the books

Closing the books is a very important part of maintaining accurate reports in your QuickBooks. Now that you know how to close the books in QuickBooks Online, set up a reminder for yourself to close the books after your tax accountant finishes your tax return. Have a great week!