Hi everyone! I am continually asked by clients how they can get more out of QuickBooks. Well, here is a great way to get the absolute most out of QuickBooks by using it to help you increase your cash flow. In my continuing series on improving cash flow (and profits) I have already covered 4 tricks for tracking past due customers and increasing cash flow and How to send past due reminders in under 30 seconds using QuickBooks Online. Now, let’s go over this week’s post – Answered: your most burning questions about how to send customer statements in QuickBooks Online.

A near cash flow disaster

I’ll never forget this story. A long time ago, in a decade far far away, I worked at a company as the head of their accounting department. The company moved from one office suite to another within the same building. In the chaos of the move, we forgot to notify the U.S. Post Office of the move. Since the mail was delivered by the postal worker at a central area inside the building, we politely asked the postal worker if he would just put our mail in the new mail slot for the new office suite. Well, apparently that is not how the U.S. Post Office works. He said that we needed to send a form to the U.S. Post Office and that he we needed to follow all the proper channels to change where our mail was delivered. He also said that it would be 7 days before our mail could be delivered to the new mail box. What???!!! That meant that for 7 days the company I worked for would not receive any customer payments via mail. We were definitely in a panic those days. The company’s cash flow would decrease significantly. Luckily, the U.S. Post Office expedited the request and my employer received their customer payments in time to avert any significant losses. Tragedy averted. However, this goes to show you how quickly a company can get into serious financial trouble if it doesn’t have a steady stream of cash flow coming in.

[bctt tweet=”A near cash flow disaster averted!” username=”5MinBookkeeping”]

What is a customer statement?

How do you keep a steady stream of cash flow coming in? Sending customer statements is one of several tools you can use to improve cash flow. A statement is a reminder you send to a customer about their purchases and payments with your company.

Statements are important for keeping your accounts up to date because they provide an overview of all outstanding payments owed to your business by customers or clients.

QuickBooks Online can help you and your customers keep track of their accounts and how much they owe you. With QuickBooks Online, you can produce these statements for your customers quickly and easily at any time with just a few clicks.

[bctt tweet=”Three super easy tools you can use today to improve your cash flow” username=”5MinBookkeeping”]

Who should you send customer statements to?

You should send customer statements to customers who have a past due balance. It is not necessary to send statements to customers who are current or who do not owe you any money.

What information is on a customer statement?

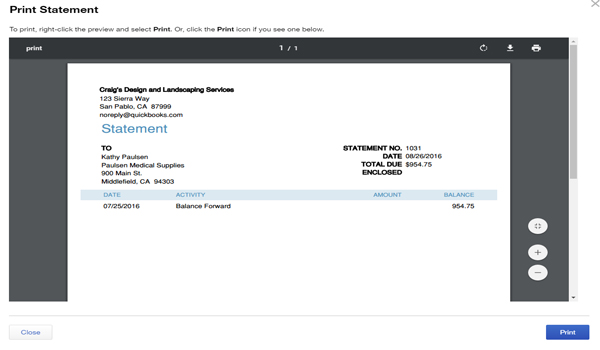

The customer statement in QBO includes the following types of transactions:

- Invoices, credit memos, and sales receipts you created

- Payments you received

Here is an example of a customer statement:

How do you create statements in QuickBooks Online?

I’ll show you how it’s done in QuickBooks… Just follow these simple and easy steps:

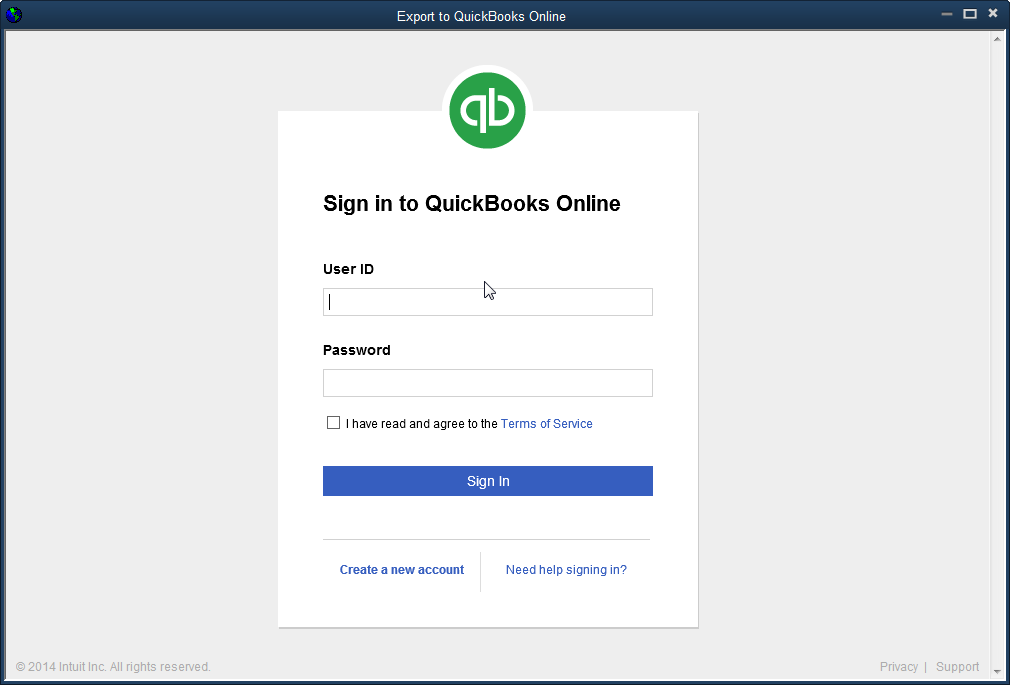

Step 1: Log in to your QuickBooks Online. Type your Username and Password on the fields.

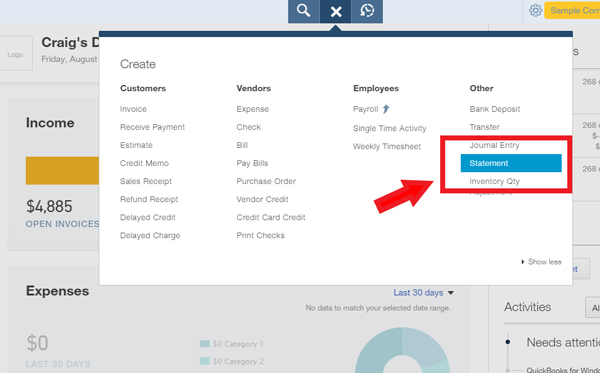

Step 2: Click the Plus (+) sign icon on the screen and select Statement.

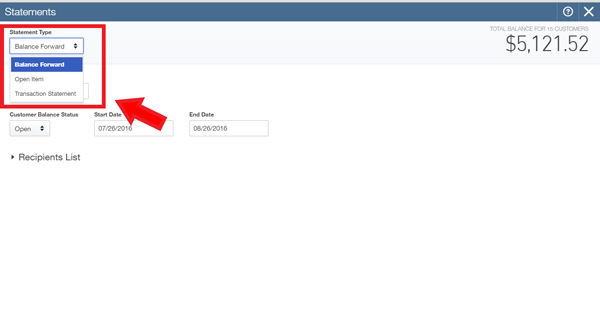

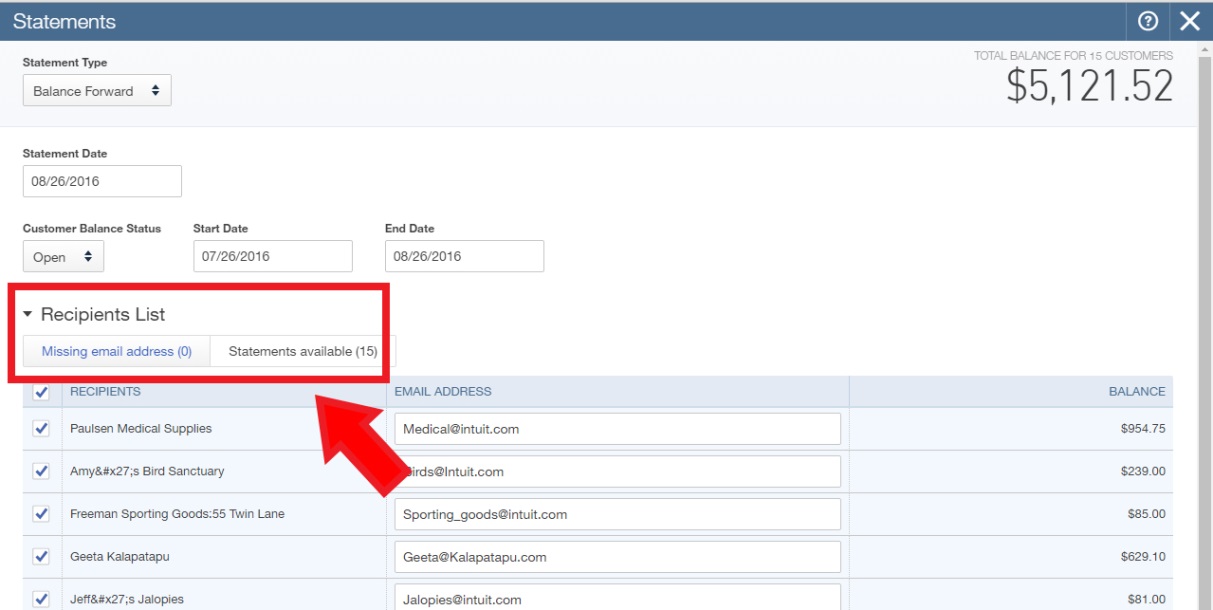

Step 3: Now you’ll see the statements window. You can choose from three types of statements: Balance Forward, Open Item, and Transaction.

Balance Forward

A balance forward statement shows all activity dated between start and end dates you choose. It has a Balance Forward amount at the top and keeps a running balance in the Balance column.

You can choose a balance status of all, open, and overdue for this type of statement. All includes customers who have a zero balance.

Open Item

An open item statement shows all invoices that have an open balance (an amount still owed). The original amount of each invoice is shown along with the open amount.

For this type of statement, you can choose a balance status of open or overdue. Customers with a zero balance don’t have open items so they’re not included when creating these kinds of statements.

Transaction

Like a balance forward statement, a transaction statement shows all activity between start and end dates you choose. But it doesn’t have a balance forward amount and amount due; it shows a total amount and amount received for the period instead.

Transaction statements can be used as donor or pledge reports. They’re useful for nonprofits and other businesses that need to send activity reports to their donors, but that don’t want to show a running balance or an amount due.

Which format should you choose?

Try each one and pick the one you like. I prefer the Open Item format. It shows all invoices with an open (unpaid) balances.

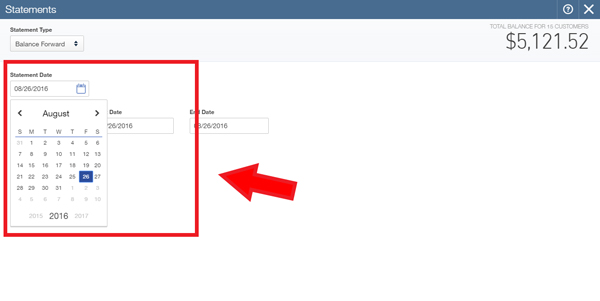

Step 4: Select a statement date or leave as is to use the current date.

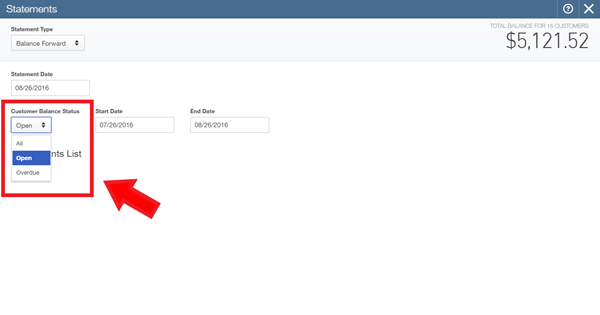

Step 5: After selecting a statement date, you can now select on Balance status: All, Open, or Overdue. (Note: you can’t select “all” for an open item statement.)

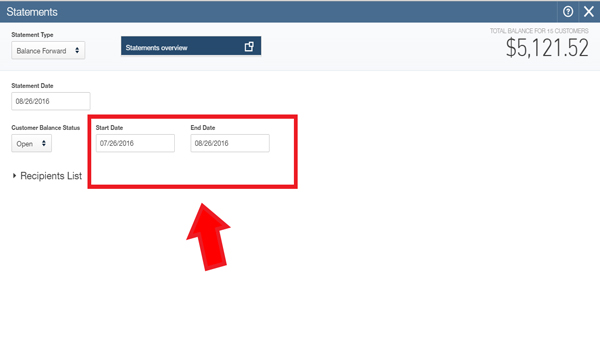

Step 6: Select Start and end dates or leave as is to use the most current month.

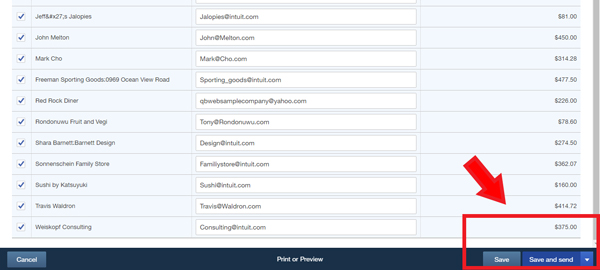

Step 7: Choose the recipients of the customer statement. You can select multiple customers to receive statements.

Step 8: After filling out all the needed information on the fields, you can now click on Save and Send. Great Job! You have just created your customer statement!

How often should you send out statements?

You should send out statements at least once a month. Remember to keep your eye on those past due balances as I showed you in my previous posts 4 tricks for tracking past due customers and increasing cash flow and How to send past due reminders in under 30 seconds using QuickBooks Online.

Parting words

Thanks for reading Answered: your most burning questions about how to send customer statements in QuickBooks Online. I’ve just shown you how to send customer statements in QuickBooks Online and why sending statements to customers is a key part of maintaining a healthy cash flow. By using customer statements regularly, you will be getting more out of QuickBooks by actively managing your cash flow as well as the business relationships you have with your clients. Thank you for reading this post, have a wonderful week!

Very detailed article. Thank you so much.