Did you know that the number one reason why small businesses fail is because of poor cash flow? Having a healthy cash flow is paramount to the success and survival of your small business. You have to tackle overdue invoices, otherwise your cash flow will suffer. But chasing customers for money is something we all naturally dread, particularly since we want to stay friendly with our customers and not burn any bridges. One of the most important ways I’ve found for improving cash flow is to stay on top of past due customer balances. It sounds easy but it’s not that simple if you’re on the go all the time. I’m going to show you 4 tricks for tracking past due customers and increasing cash flow using QuickBooks Online. You’ll be able to track overdue balances in no time – even at midnight!

[bctt tweet=”Did you know that the number one reason why small businesses fail is because of poor cash flow?” username=”5MinBookkeeping”]

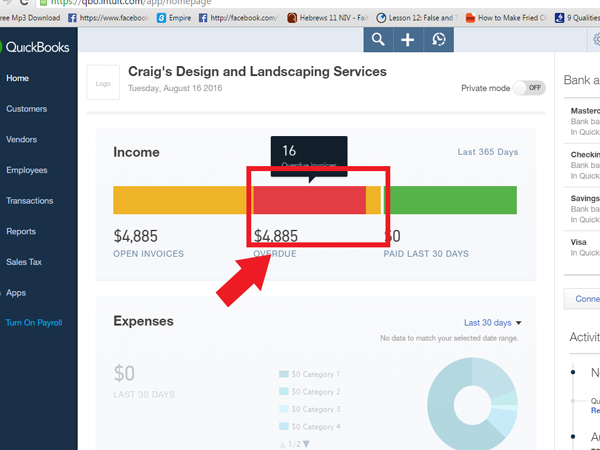

#1 – Track past due customer invoices from the Home Screen in QuickBooks Online

Log in to your QuickBooks Online.

On your QuickBooks Online Home Screen, under “Income” category, click “Overdue”.

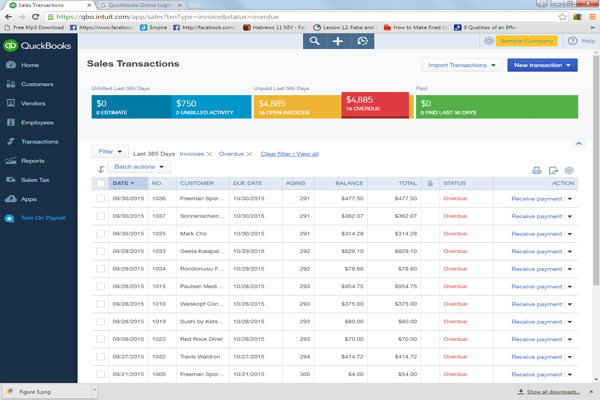

Then, a new page will appear showing all your overdue invoices. It’s that simple!

Here you will see all overdue customer invoices. “Overdue” means that invoices remain unpaid past their due date. For example, if the invoice was due on August 15 and it’s now August 20 – the invoice is now overdue by 5 days.

You’ll also see the date of the invoice, invoice number, customer name, the due date, the “aging”, the balance due, and more.

“Aging” refers to how many days have passed since the invoice became due. That is, if the invoice was due on August 15 and it’s now August 20 – the “aging” is 5 – for 5 days.

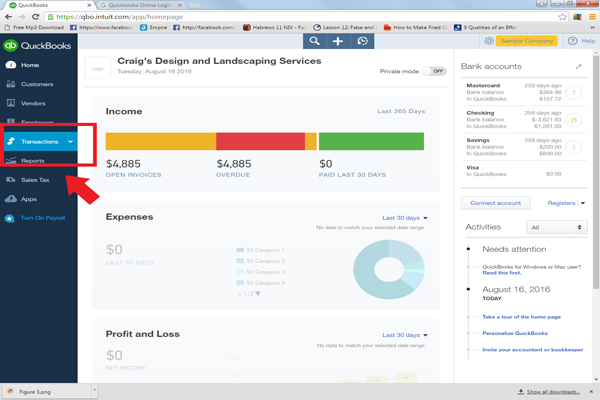

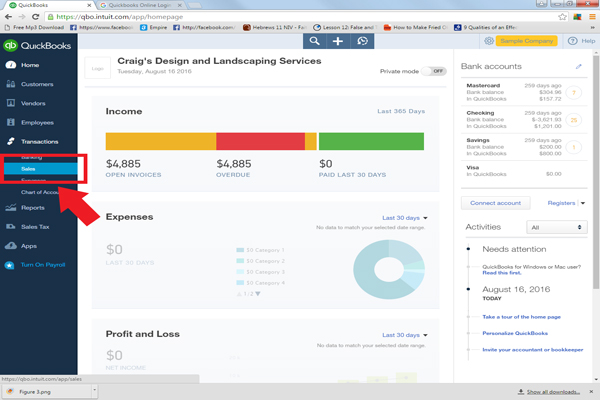

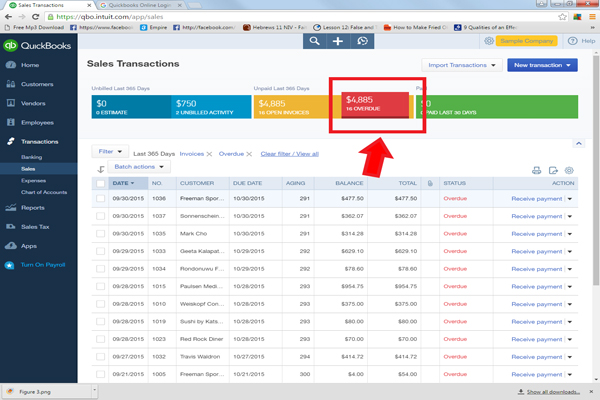

#2 – View past due customer invoices from the Left Navigation Bar

From your QuickBooks Online home screen, go to the left navigation bar and select “Transactions”.

Then choose “Sales”.

From the top menu bar, select “Overdue”.

You will see the same page showing all your overdue invoices.

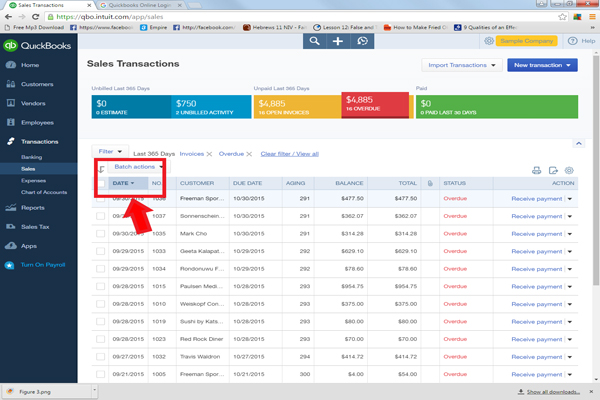

Here is another tip:

By default, the invoices are arranged from latest to oldest showing your latest transactions first on the list. If you want to see your oldest invoices first, you can click on the “Date”.

[bctt tweet=”Wow! 4 tricks for improving cash flow using @QuickBooks Online #QBO” username=”5MinBookkeeping”]

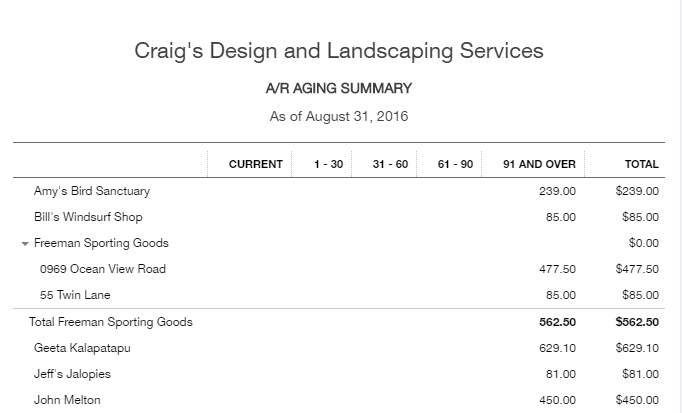

# 3 – View past due invoices from the Accounts Receivable Aging

You can run an Accounts Receivable Aging report to view past due balances by customer.

From the Left Navigation Bar, click Reports.

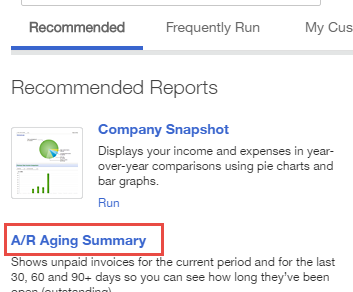

From the Recommended Reports tab, click A/R Aging Summary.

The A/R Aging Summary report will open showing all balances due from customers. It will list the totals by “Aging”. That is, how many days the balances are past due from original due date. In the example below, the company has lots of balances that are past due over 91 days.

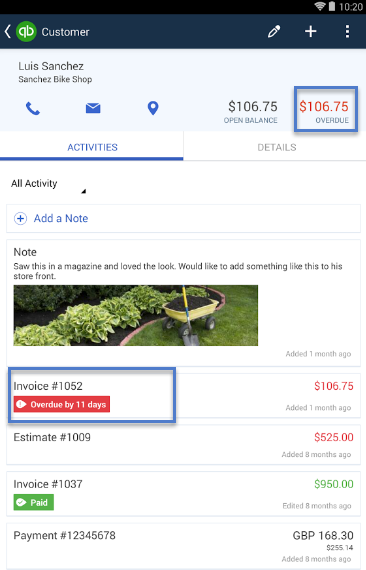

# 4 – View past due customer balances from your phone using the QuickBooks Online mobile app

Did you know you can view past due customer invoices on your smart phone? This is my favorite method because I can do it so easily.

[bctt tweet=”View past due customer invoices on your smart phone with the @QuickBooks Online mobile app #QBO” username=”5MinBookkeeping”]

If you haven’t done so already, download the QuickBooks Online mobile app into your smart phone or tablet.

Tap Customers.

Tap the Settings icon (The 3 dots on the upper right hand corner).

Tap Sort by (at the top of the list).

Select Amount Due.

You’ll see a list of all customers and the balances due from each customer.

Tap on a customer name and you will see the amounts overdue clearly indicated.

Closing

One of my biggest pet peeves is not being able to get to information when I need it – especially when it comes to tracking any balances due from customers. If you’re like me and you need to know how much a client owes you, just use one of these 4 tricks for tracking past due customer invoices and increasing cash flow with QuickBooks Online. You’ll quickly and easily find past due balances with just a few clicks or by simply using your mobile device. Leave a comment and let me know if you’ve found other ways to track past due customer balances. Stay tuned for more tips for improving cash flow – we have lots more content coming your way. Next time, I’ll show you how to send reminders to past due customers. Have a great week!

Bookkeping shouldn’t take long, but it’s also something that shouldn’t be neglected. It can help you have manage all aspects of your business, from cutting down unnecessary expenses, to avoiding penalities and findind resoruces to invest in things that help your business grow.

I agree 100%. It should definitely not be neglected. That’s why I like the idea of 5 Minute Bookkeeping. Do a little bit everyday.

Yes, I totally agree with what you said. I think that one of the main reason why some businesses fail is because of poor cashflow. I think that business owners must definitely regulate there business’ cashflow so that their business will succeed. Thanks for sharing this article.