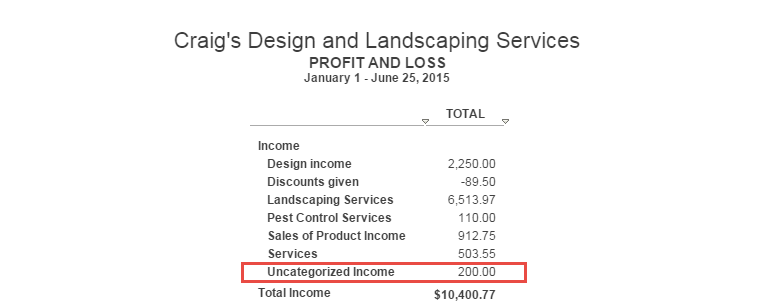

One fateful day, Jeff opened his QuickBooks Online company file to view his Profit & Loss report. He hadn’t looked through his QBO company in a while, but with tax time approaching, he wanted to make sure that nothing unusual stood out. But as Jeff looked through the Profit & Loss report, he saw two strange accounts: Uncategorized Income and Uncategorized Expense. He couldn’t remember how these accounts even got there. He thought he was doing everything right, but now he wasn’t so sure. Jeff shuddered with disbelief – his tax accountant was not going to like this. Jeff knew that he had to take action, but he didn’t know where to begin. If you’re like Jeff, and you have uncategorized income and uncategorized expenses on your books, then stick around as I show you how to fix uncategorized income and expenses in QuickBooks Online.

FAQ: Why do we see uncategorized income and expenses in QuickBooks Online?

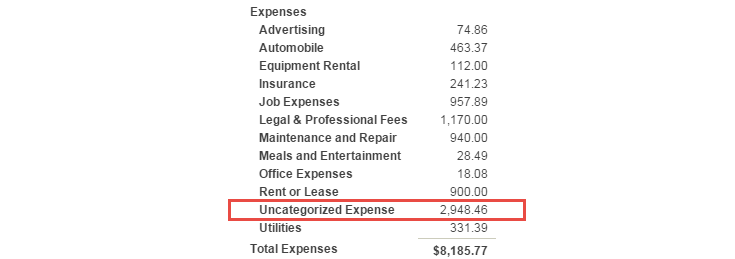

One of the most common problems that I see on the Profit & Loss report in QuickBooks Online are amounts in Uncategorized Income and Uncategorized Expense. You may not know that you have this problem. In fact, your tax accountant may bring it to your attention during tax time. If left unaddressed, your reports won’t be accurate, your accountant will be unhappy, and you’ll have to correct a lot of transactions!

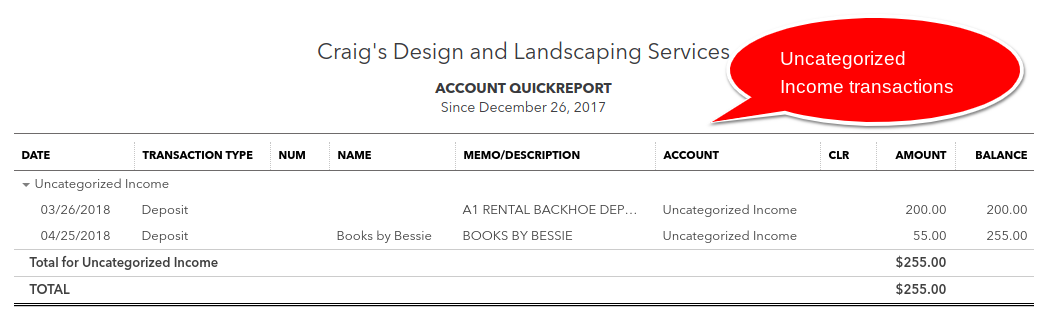

Here is an example of what these accounts look like in the Profit & Loss report:

How to tell if you have uncategorized income an uncategorized expense transactions in QBO

Here is a video you can follow along:

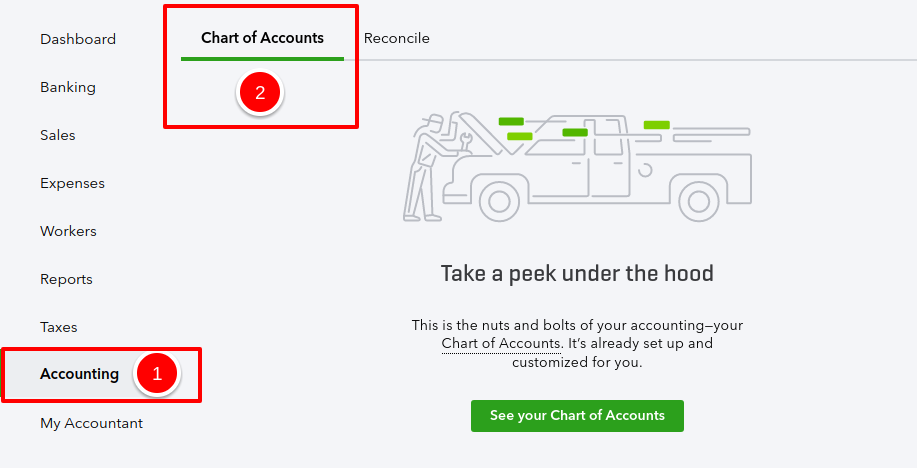

You can easily find these uncategorized transactions by running a “quick report”. Simply go to the Left Navigation Bar,

- Click on Accounting.

- Then, select Chart of Accounts.

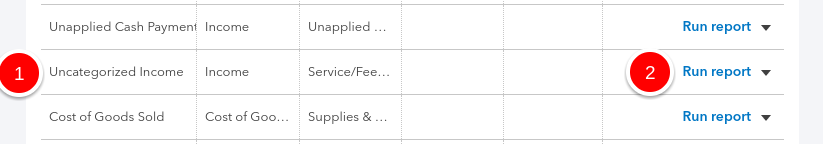

- In the Chart of Accounts, scroll down until you see the account called “Uncategorized Income” or “Uncategorized Expense”.

- Then, click on Run Report on the far-right.

A “quick report” window will open showing you all transactions in the account.

Why are there uncategorized income and uncategorized expense transactions in QBO?

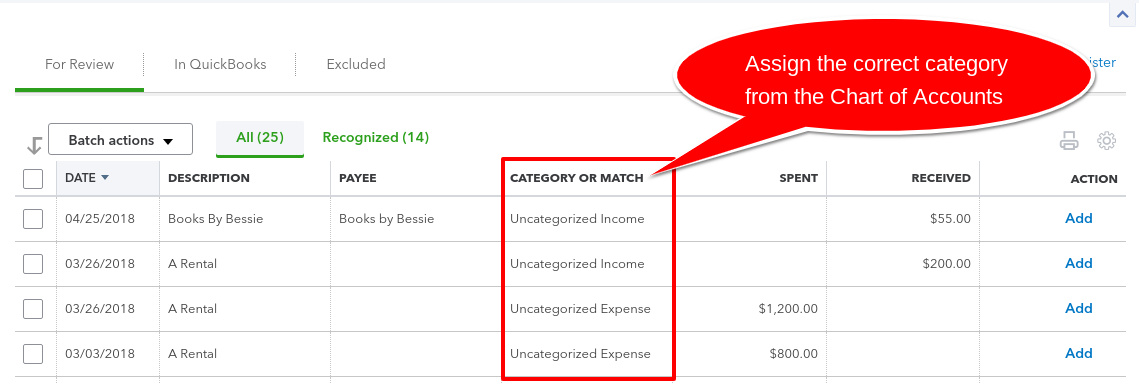

It all starts with downloaded banking transactions. When banking transactions are downloaded into QuickBooks Online, QBO can’t always figure out how to categorize the transaction. In that case, QBO assigns the Uncategorized Income account to amounts received and the Uncategorized Expense account to amounts paid.

To avoid this, you need to tell QuickBooks Online how to categorize the transactions. So, if you ever see Uncategorized Income in the “Category or Match” column, you should select the appropriate category (or account from your chart of accounts).

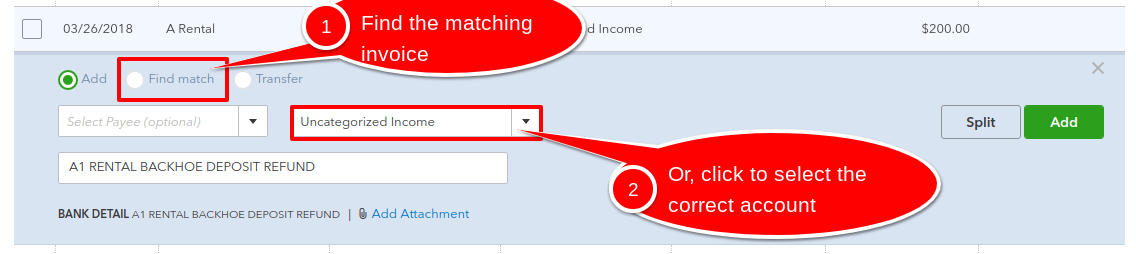

For an amount received (a deposit), click on the transaction to view more details. Depending on the type of deposit you will

- Click Find Match to apply the payment to an invoice you have already entered in QBO.

-OR-

- Choose an income account from the Chart of Accounts.

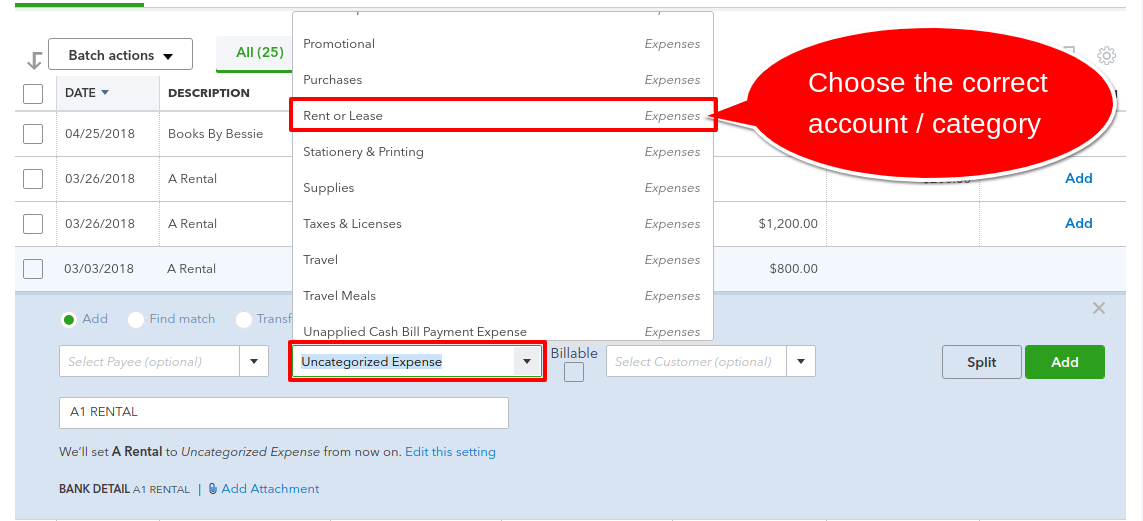

If you see Uncategorized Expense in the “Category or Match” column then click on the transaction to view more details. Select an expense category (or account from your chart of accounts) to classify the expense transaction.

How to fix transactions recorded to uncategorized expenses in QBO

If you accidentally recorded transactions to uncategorized expenses, you can easily edit the expense transactions. There is no need to delete them and start over.

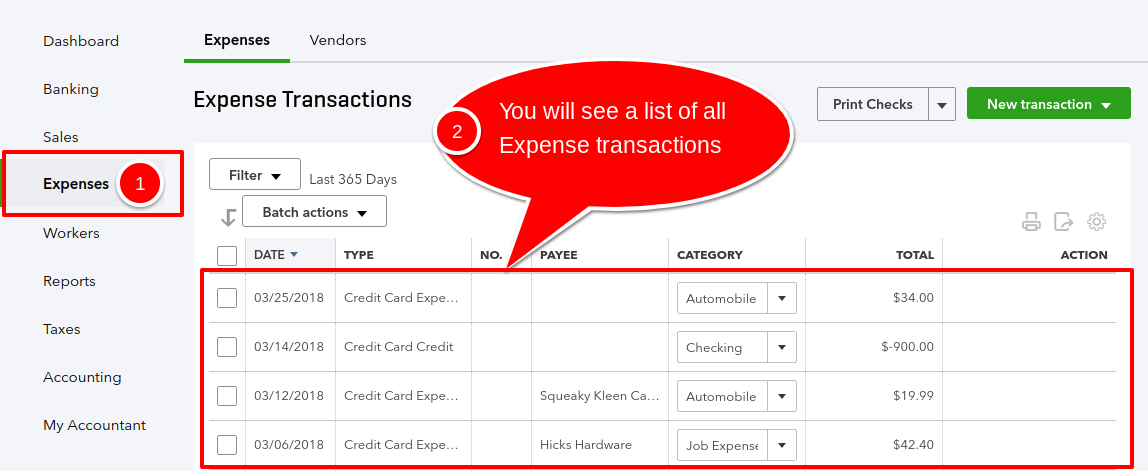

- Click on Expenses in the Left Navigation Bar.

- You be taken to the Expenses Center where you will see a list of all expenses.

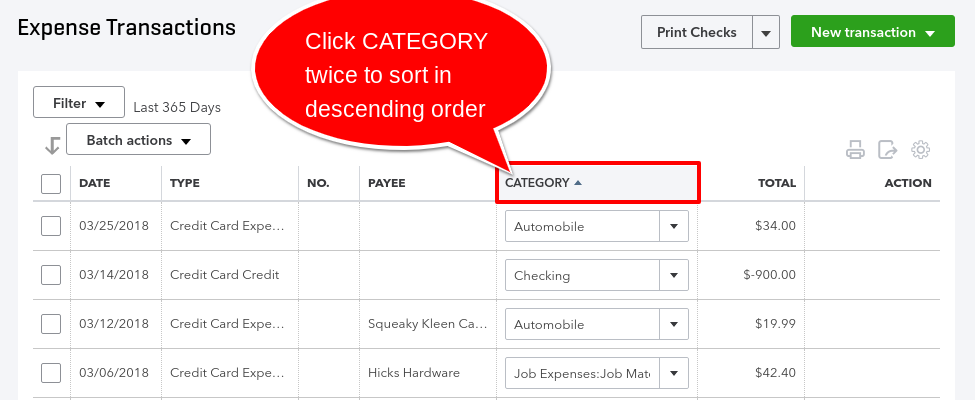

Click on the Category column to sort transactions by category.

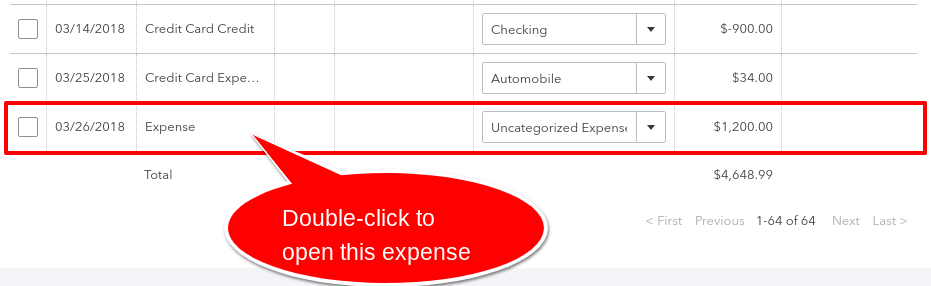

Scroll down until you see Uncategorized Expense. Double-click on each transaction to open it.

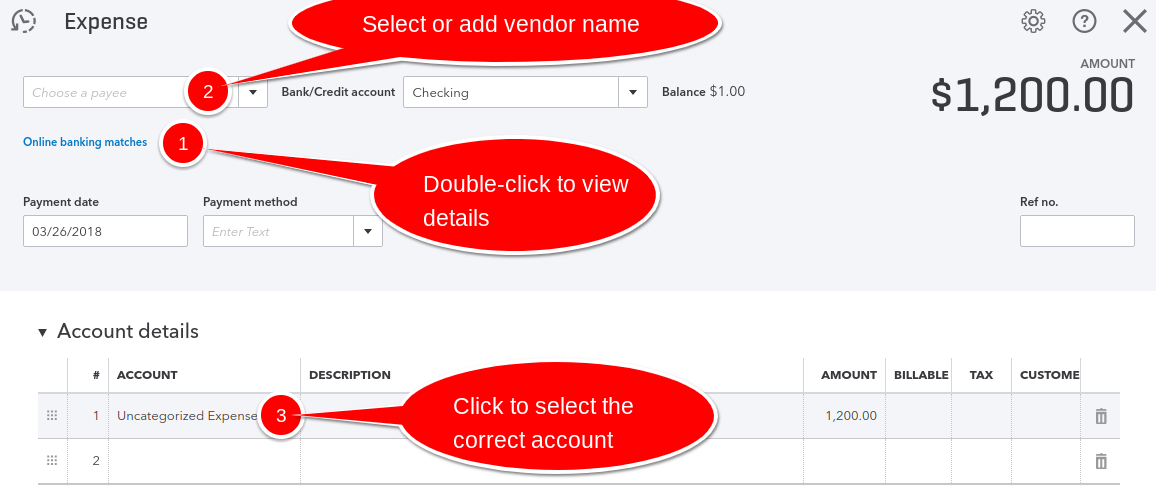

- Click on Online banking matches to view the details of the transaction.

- Assign or add the vendor name.

- Change the account from Uncategorized Expense to the correct expense account.

How to fix transactions recorded to uncategorized income in QBO

These transactions can be tricky to correct because you may have already entered an invoice, a customer payment, or even a deposit and you may have already prepared bank reconciliations in QBO. Each transaction should be reviewed individually and corrected depending on what else is already recorded in QBO. I recommend that you contact a QuickBooks Online Proadvisor to help you correct these.

Closing

Well, Jeff is glad that he now knows how to fix uncategorized income and expenses in QuickBooks Online. He found the information to be extremely helpful, and went to work, immediately, on recategorizing all of his uncategorized income and expense transactions.

I hope that you found this information useful as well, and that you will check to see if you have uncategorized income or uncategorized expenses in QuickBooks Online. I highly recommend that you check this on a regular basis and that you correct any transactions right away. Remember, 5MinuteBookkeeping is much better than 5-hour bookkeeping!

Any comments or questions? Just post it below and I’ll reply as soon as I can!