In my previous post, I covered the 4 basics for small business tax survival. In this post, I’ll cover the first essential to make it through tax season – you need to make some basic decisions and you need to make them within the first 2 weeks of January.

Decisions you need to make:

- Will you hire a professional tax preparer?

- Do you need professional help with your small business accounting and bookkeeping?

- Do you need to hire an assistant to help you get organized?

In other words – do you need to hire a professional and/or an assistant to help you?

I highly recommend that you hire a professional to help you with bookkeeping, cleaning up your QuickBooks file, or preparing your small business tax return. Accounting and tax pro’s are trained experts and they can do your small business bookkeeping and taxes faster and better than you can. You won’t have to worry that you may be screwing things up or that you may into trouble with the IRS.

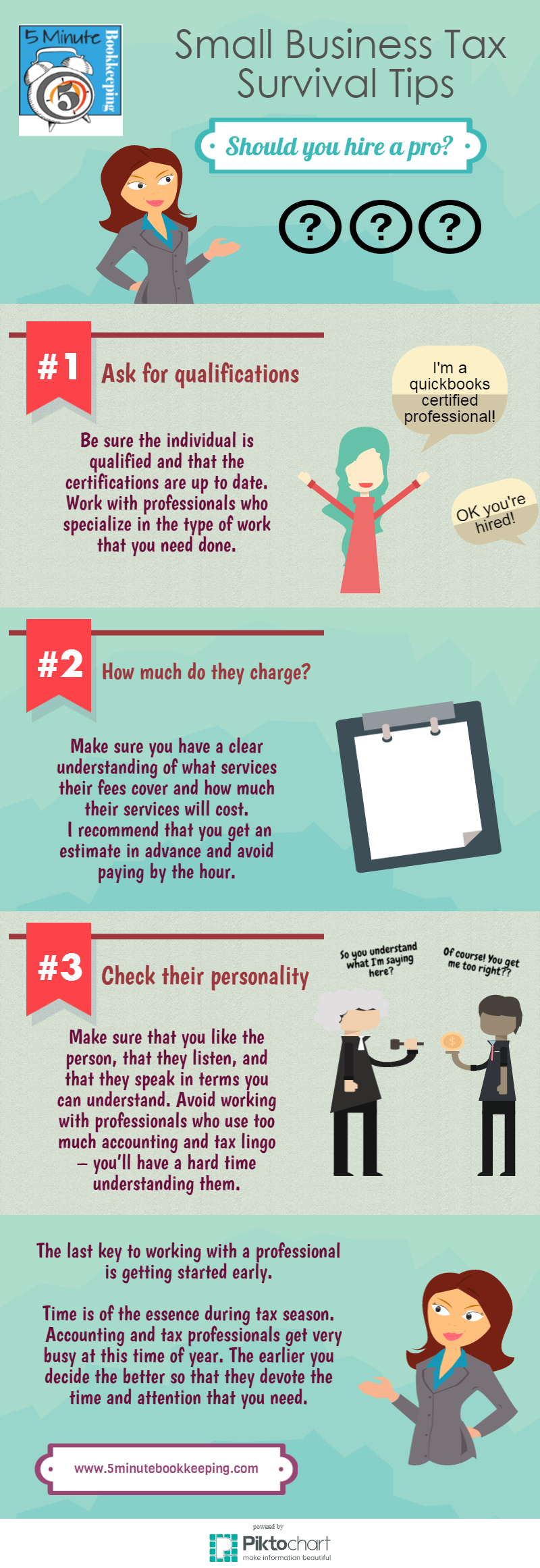

Having said that, not all professionals are the same. Here are 3 keys to selecting an accounting and/or tax professional:

- Qualifications – be sure that the individual is qualified and that their certifications are up to date. Ask about their qualifications and experience and check them out. Also, work with professionals who specialize in the type of work that you need done. A QuickBooks expert will do a great job of cleaning up your QuickBooks file but they may not be the best at preparing your tax return. A tax preparer may prefer to concentrate on preparing your small business tax return and not on cleaning up your bookkeeping.

- Fees – make sure you have a clear understanding of what services their fees cover and how much their services will cost. I recommend that you get an estimate in advance and avoid paying by the hour.

- Personality fit – make sure that you like the person, that they listen, and that they speak in terms you can understand. Avoid working with professionals who use too much accounting and tax lingo – you’ll have a hard time understanding them.

The last key to working with a professional is getting started early

Time is of the essence during tax season. Accounting and tax professionals get very busy at this time of year. The earlier you decide the better so that they devote the time and attention that you need.

On my next post I’ll talk about getting your small business bookkeeping under control and ready for tax season. Stay tuned and leave a comment to let me know how you are coping with tax season this year.

Here’s an infographic for you to save: