Jill and Bob run a prominent consulting business. Since they were still new to QuickBooks Online, Jill and Bob connected ALL of their business and personal bank and credit card accounts to QBO. Jill and Bob became really confused when working with their bank feeds. They saw obvious personal expenses, including their cruise vacation to the Bahamas. Upon closer review, they started wondering whether their cruise vacation expense really belonged in QBO. Soon, this simple question turned into a pressing dilemma. Jill and Bob started worrying and wondering, “If we include our vacation expense in QBO, will the IRS eventually come after us?”. Have no worries Jill and Bob, because in this blog post, I’m going to answer a common question: Should you track your personal accounts in QuickBooks Online?

First, let’s go over the difference between business and personal expenses.

Differences between business and personal expenses

According to the IRS, business expenses are all the expenses which are ordinary and necessary in running a business. The distinguishing feature of business expenses is that they are tax deductible, with some minor exceptions.

Examples of business expenses include, but are not limited to:

- Repairs & maintenance

- Office supplies

- Payroll for employees

- Payments to independent contractors

Personal expenses are those expenses which you incur outside of running your business. Personal expenses are unrelated to your business.

Examples of personal expenses include, but are not limited to:

- Buying groceries

- Taking your family out to dinner

- Vacation expense

While these examples of business and personal expenses are clear cut, sometimes the distinction between business and personal expenses can be very vague.

Common personal expenses that get confused with business expenses

Sometimes, personal expenses can get misinterpreted as a business expense. Here are some examples:

Meals and Entertainment expenses can sometimes become unintentionally commingled (mixed together) with business and personal expenses. The distinction between a business meal or personal meal depends on the circumstances of the meal. For example:

- If you’re taking a client out for lunch to discuss business, then you have a genuine business expense.

- However, if you’re going out to eat with the family, then you’ve got yourself a personal expense.

Mortgage payments and home utilities expenses are also commonly, but erroneously, recorded in QBO. Why are they recorded? Because, the business owner generally believes they are allowed a deduction for home-office related expenses. It is important to remember that QBO is meant to summarize business expenses only. To get a clear answer on how to handle home-related expenses, consult with your tax preparer on how you should track these expenses.

Should I add personal bank or credit card accounts to QuickBooks Online?

Bad idea. In fact, you should avoid comingling your business and personal expenses. The best way to ensure clear distinction between business and personal expenses is to use separate bank and credit card accounts for each.

For each bank and credit card account, designate it as exclusively business or personal. Connect only your business accounts to QBO. This way you won’t have to worry about seeing personal expenses in QBO.

Common question: Why can’t I track my personal expenses in a separate class?

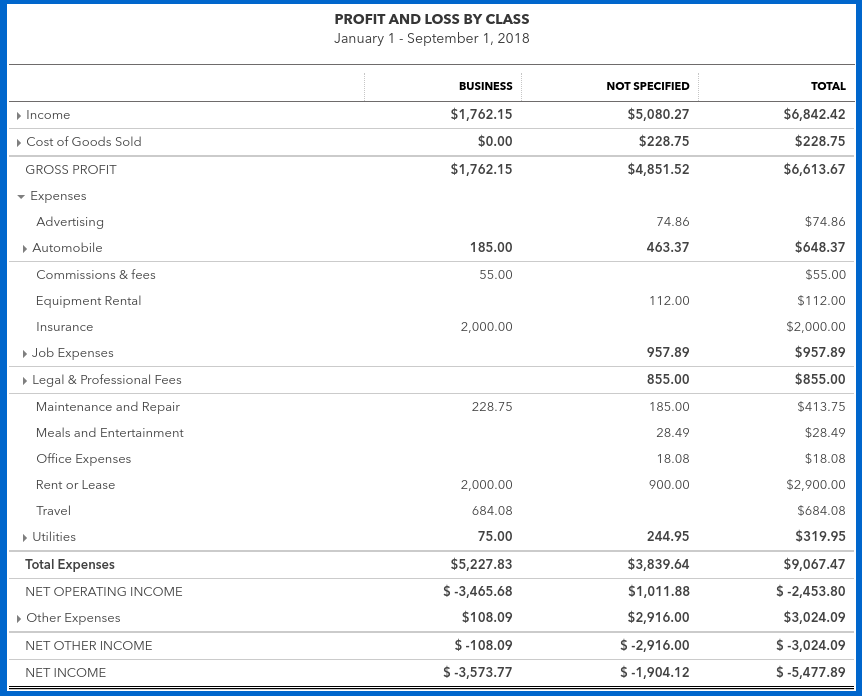

Some business owners make use of class tracking in QBO Plus, to split their Profit and Loss report into several columns.

Here is an example of a Profit and Loss report by class:

So, the logic goes: “Why can’t I just use a separate Class for personal expenses?”

Because, with class tracking the personal expenses will still appear in the Profit & Loss report, where they don’t belong. Adding a separate class for personal expenses also adds another layer of complexity, which increases the likelihood of errors, such as mis categorizing expenses. The IRS expects your books to show only business income and expenses. If you track personal expenses in QBO and you were audited by the IRS, then there may be consequences.

Consequences of commingling business and personal expenses

The IRS expects your books to show only business income and expenses. If you track personal expenses in QBO and you were audited by the IRS, then there may be consequences. An IRS audit can uncover personal expenses which have been disguised as business expenses, leading to potentially hefty tax penalties.

Closing

Now that I’ve answered the question: ‘Should you track your personal accounts in QuickBooks Online?’, you may want to look at the bank and credit card accounts connected to your QBO to determine if any of them are personal accounts. It is important to keep personal accounts out of QBO. This may not seem significant but may reduce the likelihood of an IRS audit and will lower your tax preparation fees.

[bctt tweet=”It is important to keep personal accounts out of QBO” username=”5MinBookkeeping”]

Now that Jill and Bob understand that their cruise vacation was a personal expense and does not belong in QBO, they are ready to disconnect the personal account and delete personal expenses. Although the cruise expense was clearly a personal expense, there were a few legitimate business expenses on their personal account. But how should they handle these? It looks like Jill and Bob still need some additional help. In my next blog post, I’ll show you how to record and clean up personal expenses in QuickBooks Online.

Join our FaceBook community

Want to connect with others, ask questions, and exchange ideas? Then, join our Facebook Community – 5 Minute Bookkeeping with QuickBooks Online.