Jasmine Jones is the proud owner of Jasmine’s Cupcake Design Emporium. She is a graphics designer for cupcake shops all over the country. By the nature of her business, Jasmine sends out a lot of invoices and receives a lot of vendor bills. After a long and busy year, Jasmine is confident that her QuickBooks is all up to date, so she hands her reports off to her tax accountant. A week later, Jasmine’s tax accountant reaches out to her and says, “Jasmine, what are these strange income and expense accounts I see on your reports?” The tax accountant points out two specific accounts: Unapplied Cash Payment Income and Unapplied Cash Payment Expense. Jasmine, is confused. She’s never heard of these accounts before. Jasmine’s dilemma is not unique. Numerous QBO users are confused by the sight of unapplied cash payments. But, fear not – I’ll show you and entrepreneurs like Jasmine what unapplied cash payments are and how to fix unapplied cash payments in QuickBooks Online.

What are unapplied cash payments?

Generally, unapplied cash payments are adjustments that QuickBooks records automatically to fix inconsistencies between invoices and customer payments, or between vendor bills and bill payments. Keep reading, and I’ll show you and Jasmine how to find unapplied cash payments.

How do you know if you have unapplied cash payments in QuickBooks Online?

You can easily find out by running a Profit and Loss report. As a brief review, the Profit and Loss report summarizes revenues and expenses.

To find unapplied cash:

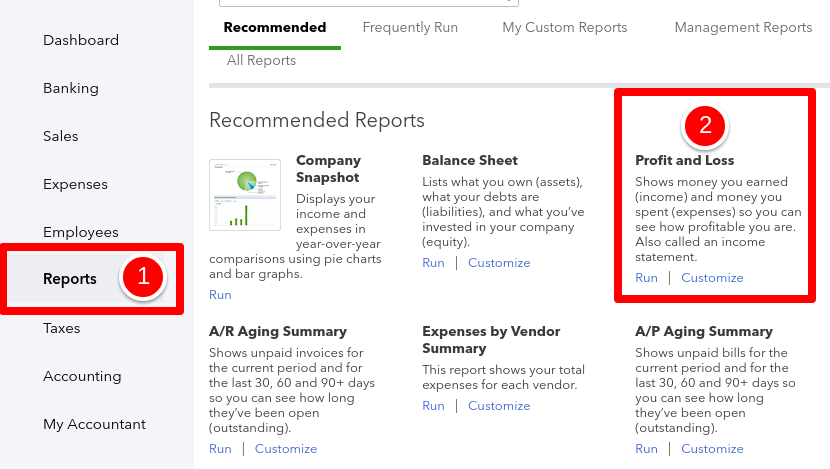

1. Go to the Reports section on the Left Navigation Bar.

2. Open a Profit and Loss report.

3. Select “Cash Basis” as the Accounting method.

4. Click “Run Report.”

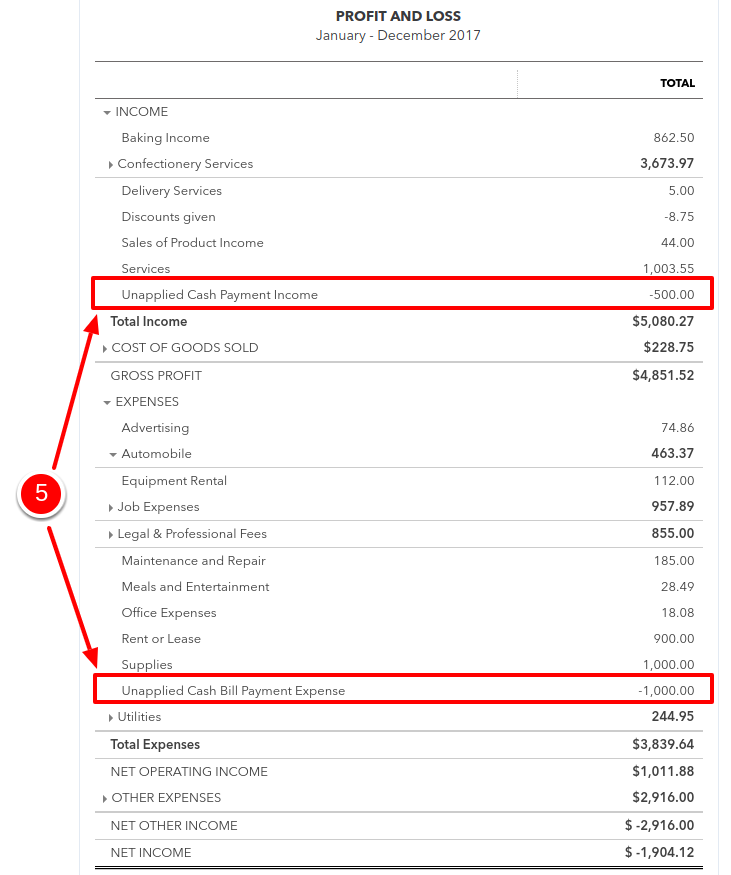

5. Now, look for accounts called Unapplied Cash Payment Income and Unapplied Cash Payment Expense.

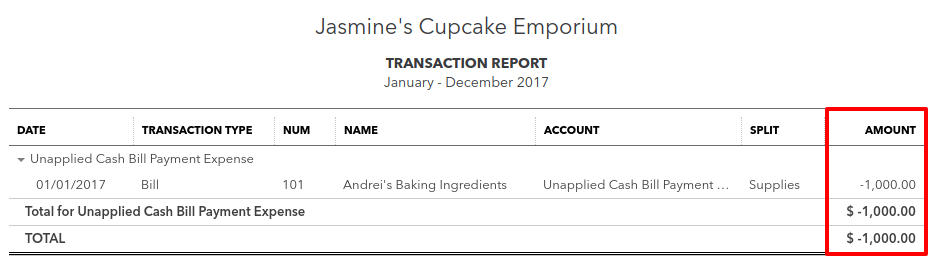

Ouch! This looks complicated, but it’s not. Let’s work through some scenarios on why QBO records adjustments to Unapplied Cash Payment Expense and Unapplied Cash Payment Income.

Let’s go through an example of unapplied cash payment expense

In this scenario:

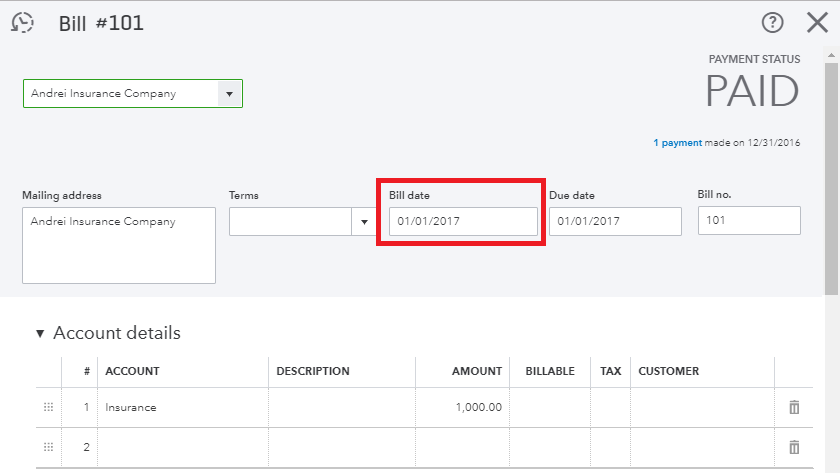

Jasmine entered a vendor bill in QuickBooks and dated it 01/01/2017.

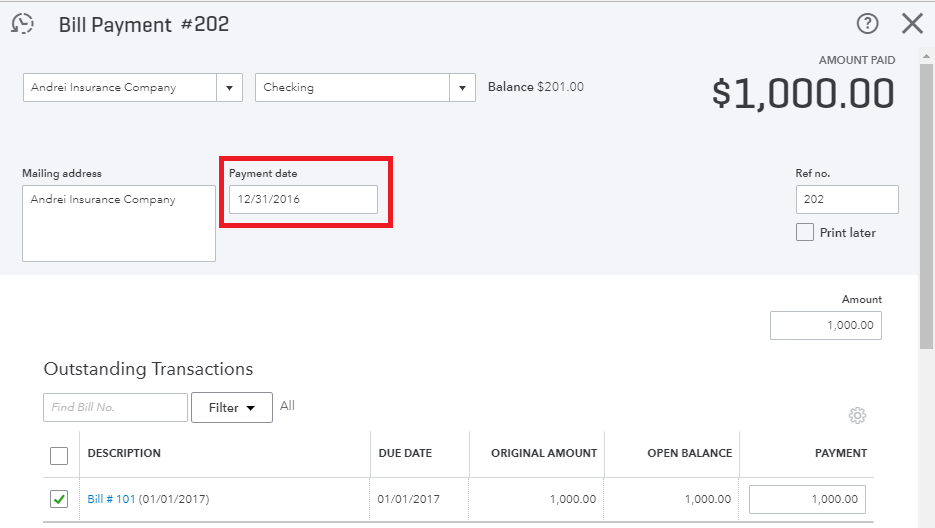

And then, Jasmine marked the vendor bill as paid (by entering a Bill Payment) in QuickBooks with a date of 12/31/2016.

Something is not right.

Jasmine entered a vendor bill dated in January 2017, but then marked the vendor bill as paid in December 2016. Do you see the problem? Jasmine entered the vendor bill on the wrong date. She should have entered the vendor bill with a date of 12/31/2016 and not 01/01/2017. As a result, QuickBooks now has to make an adjustment to Unapplied Cash Payment Expense. That’s because the vendor bill should have been dated on or before the date of the bill payment.

Unapplied cash payment expense will now stick out like a sore thumb on Jasmine’s Profit and Loss report.

Most of the time, the reason for unapplied cash is actually just a simple recording error. But an error is still an error, and so it needs to be fixed.

[bctt tweet=”Got unapplied cash payments in QBO? There’s an easy fix for that.” username=”5MinBookkeeping”]

How do you fix unapplied cash payment expense?

To fix unapplied cash payment expense, Jasmine needs to know some facts. Specifically:

- What was the actual date of the vendor bill?

- When was the vendor bill actually paid?

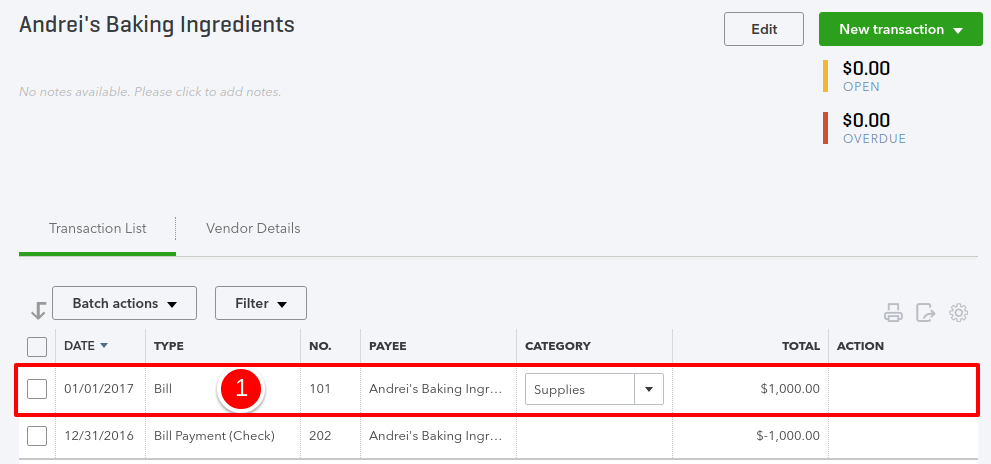

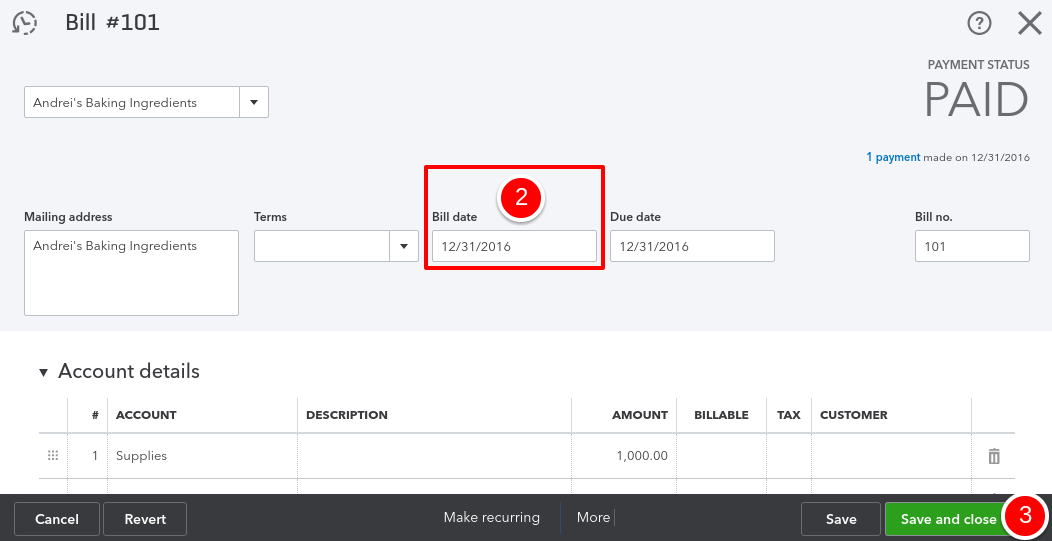

Continuing with our previous scenario, let’s say that the vendor bill was actually dated 12/31/2016, but Jasmine accidentally entered the vendor bill with a date of 01/01/2017 in QBO. So, to correct this simple error, Jasmine must change the date of the vendor bill in QuickBooks to the correct date.

To change the date of a vendor bill in QBO:

1. Find and open the vendor bill in QuickBooks. To learn how to find transactions in QBO, check out our blog post: How to find transactions in QuickBooks Online.

2. Select the Bill date, and change it from 01/01/2017 to 12/31/2016.

3. When finished, select Save and close.

After making this simple correction, the balance in unapplied cash payment expense for this vendor bill will disappear.

Expert Tip: To avoid Unapplied Cash Payment Expenses in QBO, pay close attention to the dates you use to enter vendor bills and bill payments.

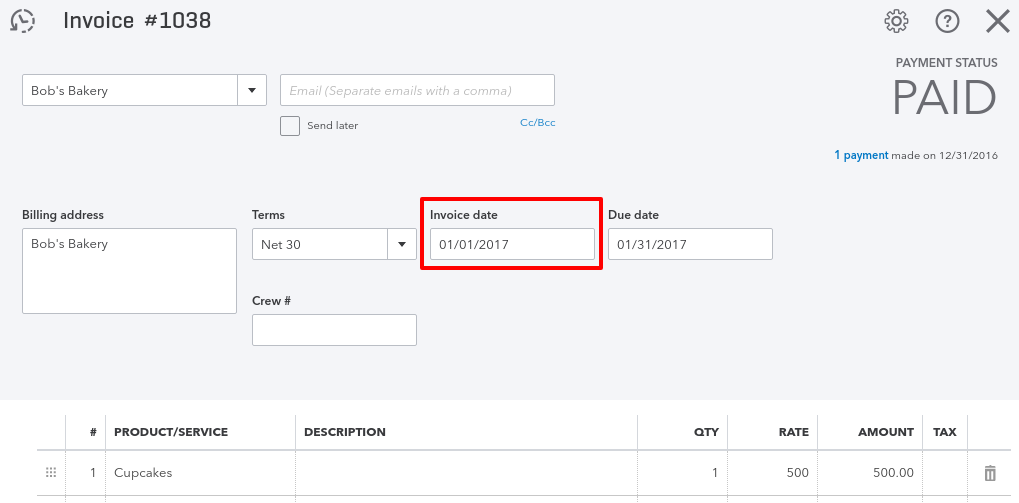

Let’s go through an example of unapplied cash payment income

Unapplied cash payment income is the exact opposite of unapplied cash payment expense.

In this scenario:

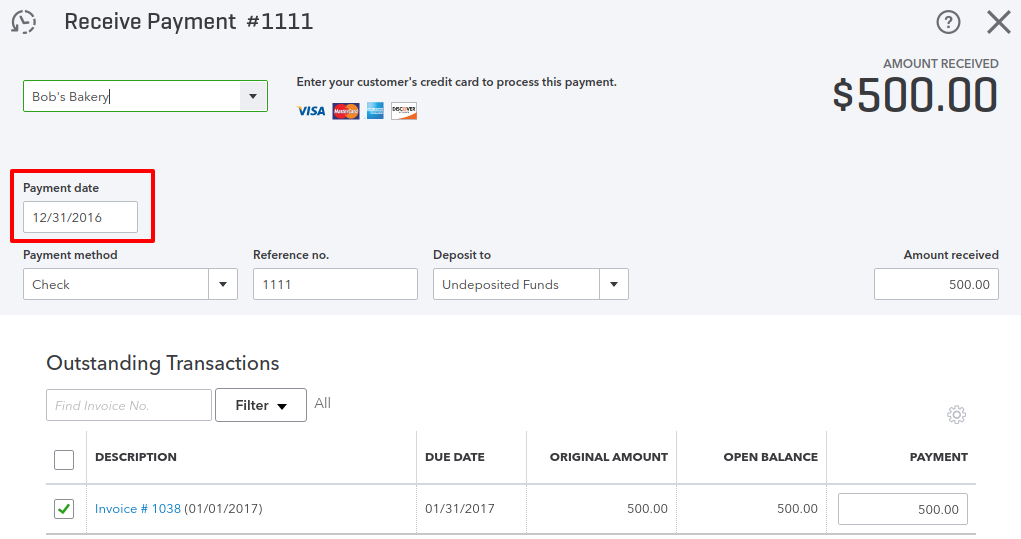

Jasmine entered a customer invoice in QuickBooks and dated it 01/01/2017.

Then, Jasmine entered a customer payment in QuickBooks and dated it 12/31/2016.

Once again, something is not right.

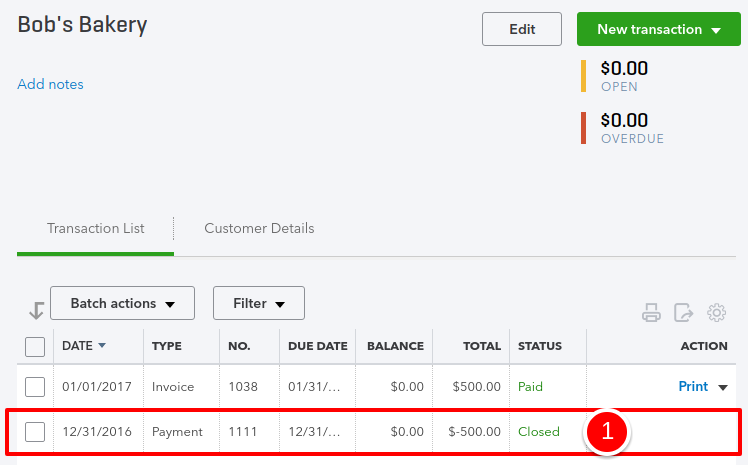

Jasmine entered a customer invoice dated January 2017, but then Jasmine entered the customer payment dated in December 2016. Again, something has been entered with the wrong date and QuickBooks is forced to make an adjustment. But, this time, the adjustment is to Unapplied Cash Payment Income.

Now, its Unapplied Cash Payment Income that will haunt Jasmine’s Profit and Loss report.

How do you fix unapplied cash payment income?

To fix unapplied cash payment income, Jasmine must follow a similar set of steps she took to fix unapplied cash payment expense. Specifically:

- Determine the actual date of the customer invoice.

- Determine the actual date of the customer payment.

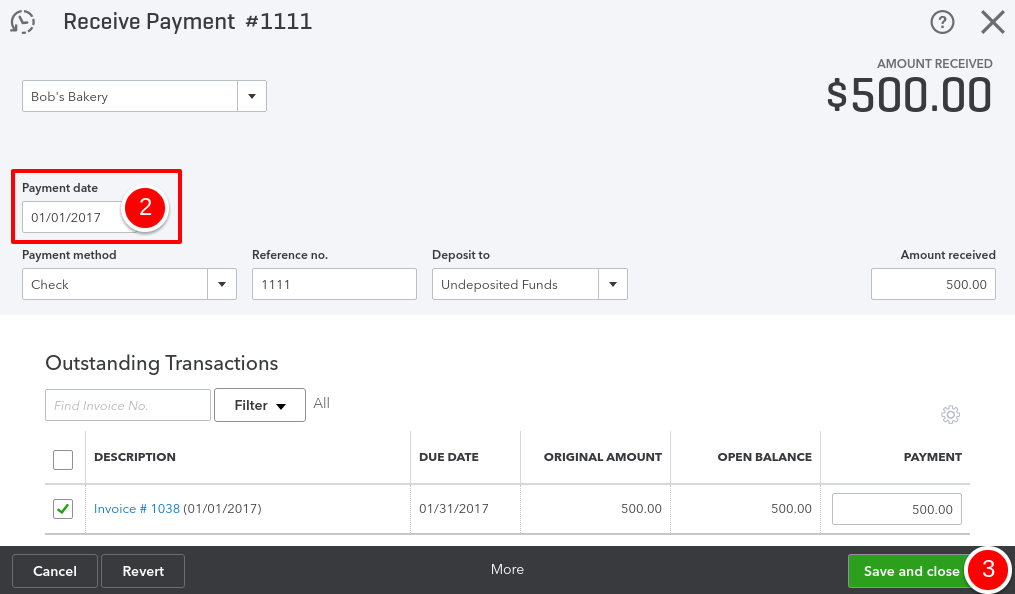

This time, Jasmine determined that the actual date of the customer invoice was correct. The customer invoice was, in-fact, dated 01/01/2017. However, the actual date of the customer payment was 01/15/2017, but instead, Jasmine entered it in QBO with a date of 12/31/2016. Because the customer payment was entered on the wrong date, Jasmine must change the date of the customer payment in QuickBooks.

To change the date of a customer payment in QBO:

1. Find and open the customer payment in QBO.

2. Select the Payment date, and change it from 12/31/2016 to 01/15/2017.

3. Select Save and close.

If Jasmine makes the correct changes, then the balance in unapplied cash payment income for this invoice will disappear.

Expert Tip: To avoid Unapplied Cash Payment Income in QBO, pay close attention to the dates you use to enter customer invoices and customer payments.

Closing

After realizing that the unapplied cash payments in her reports were the result of a few simple recording errors, Jasmine handed off her reports to her tax accountant. The accountant was pleased, and complemented Jasmine on her thorough work, as usual. Jasmine’s reports were in good order, but she promised herself to pay extra careful attention to the dates of the transactions entered in QuickBooks.

Hi,

What if the customer payment is correct and just pre-paid the invoice?

Hi Susy,

If the customer payment and the invoice are in the same month, it should be OK. But if they happen in different months (or different years), then its best to make an adjustment. These are multiple ways you can do this. Definitely, ask this question our Facebook group and they can give you some suggestions: https://www.facebook.com/groups/5minutebookkeeping/