Eric is busy these days. He’s running a business and does his best to keep track of his numbers. Despite his best intentions, Eric is a bit disorganized and still hasn’t quite figured out how to use QuickBooks Online. While reviewing his numbers, Eric sees an unusually large balance in Undeposited Funds. He’s really confused and he doesn’t know what to do. Eric is now worried that all these undeposited customer payments will distort his financials and affect his taxes. Eric’s dilemma is something many untrained QBO users experience. So today, I’m going to show you how to clean up Undeposited Funds in QuickBooks Online.

Here’s a video tutorial, showing you two methods you can clean up Undeposited Funds.

Wait! What are Undeposited Funds?

If you’re new to QBO, you may be unfamiliar with what we are referencing when we say the ‘Undeposited Funds account’. If so, check out this blog post – Unraveling the mysteries of the QuickBooks Online undeposited funds account. It will help you to better understand the Undeposited Funds account in QBO.

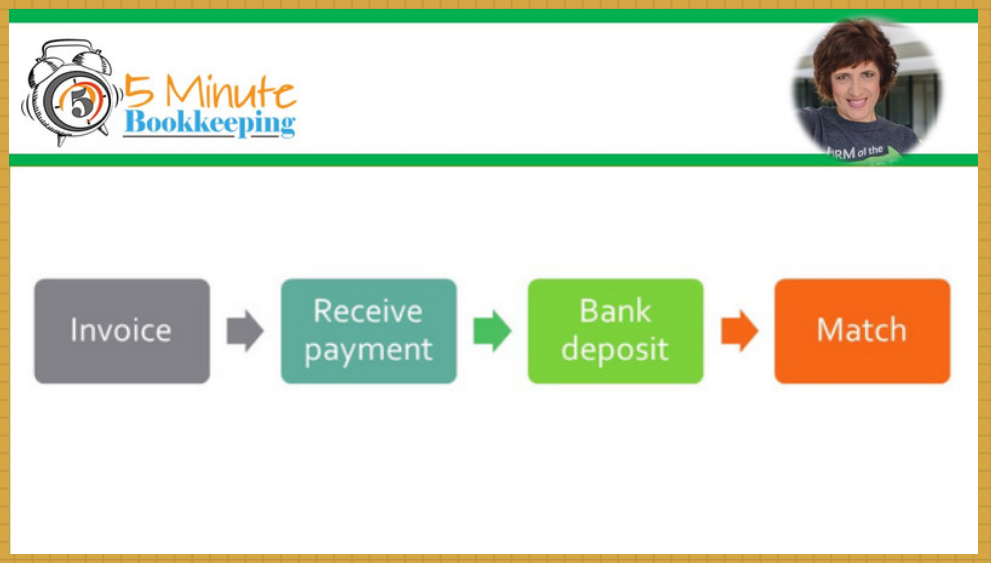

Money-in transactions in QBO

Once you’ve got that out of the way, let’s get familiar with the “money-in” transaction process. Understanding this process is essential if you want to learn how to clean up Undeposited Funds.

Here’s a chart showing the proper order of a typical money-in transaction in QBO.

Reconcile first before cleaning up Undeposited Funds

Before proceeding to clean up Undeposited Funds, make sure that your bank accounts are reconciled. You can learn more about reconciling bank account by reading this blog post – Why the 90s called and they don’t want their bank reconciliation back.

Here’s a video tutorial on how to reconcile a bank or credit card account

As a best practice – we highly recommend that all bank accounts be reconciled first, before cleaning up Undeposited Funds. Here at VM Wasek, we always reconcile before performing major cleanups of our clients’ Undeposited Funds.

[bctt tweet=”As a best practice – we highly recommend that all bank accounts be reconciled first, before cleaning up Undeposited Funds.” username=”5MinBookkeeping”]

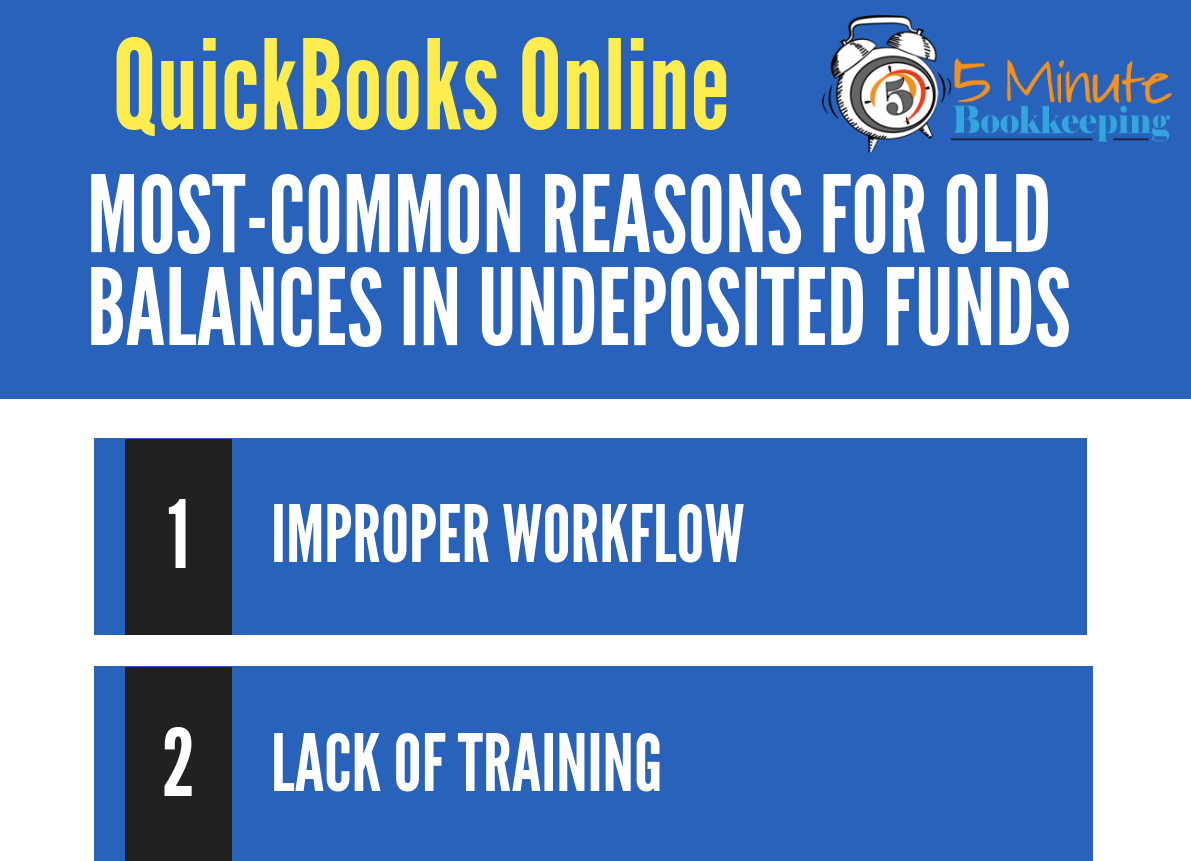

The most-common reasons for old payments Undeposited Funds account in QuickBooks Online

In this section, I’ll go over some common reasons for having old payments in Undeposited Funds.

1. Improper workflow

The #1 reason for old customer payments in undeposited funds is an improper workflow.

Let’s work through an example of an improper workflow:

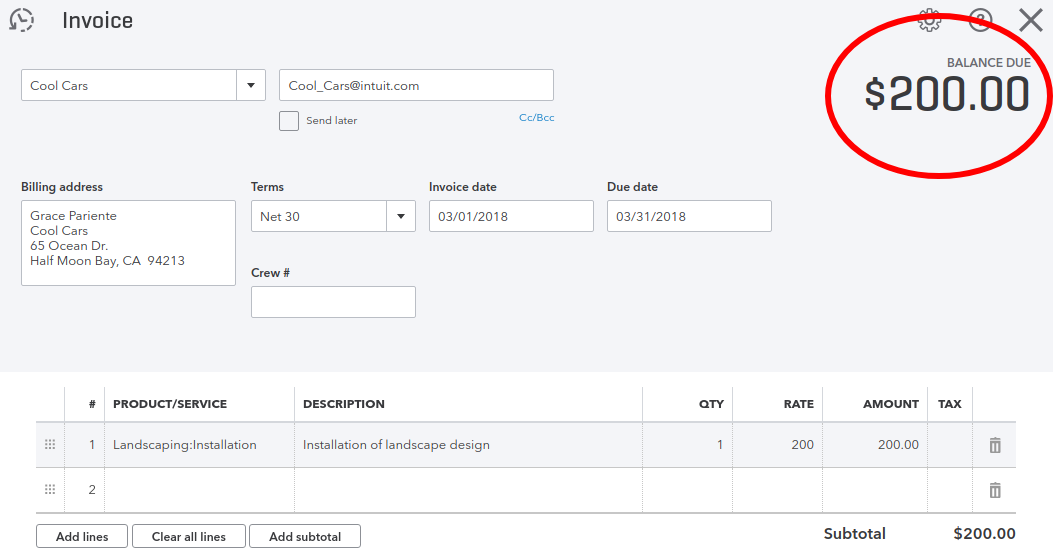

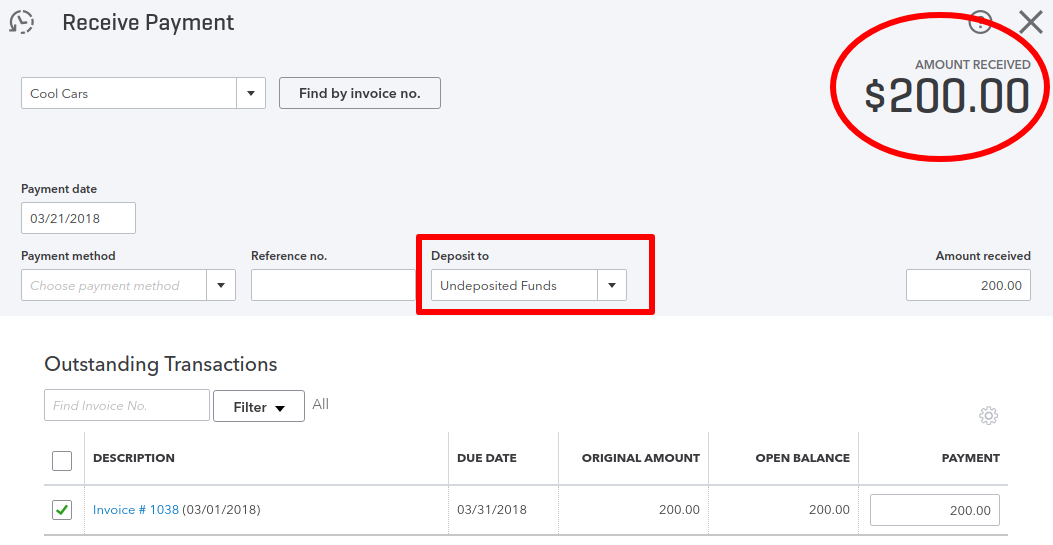

Eric sent Cool Cars a customer invoice for $200 and recorded it on 3/1/18.

Eric later received a payment from the customer. He recorded the customer payment on 3/21/18 for the amount of $200. The customer payment was recorded to Undeposited Funds.

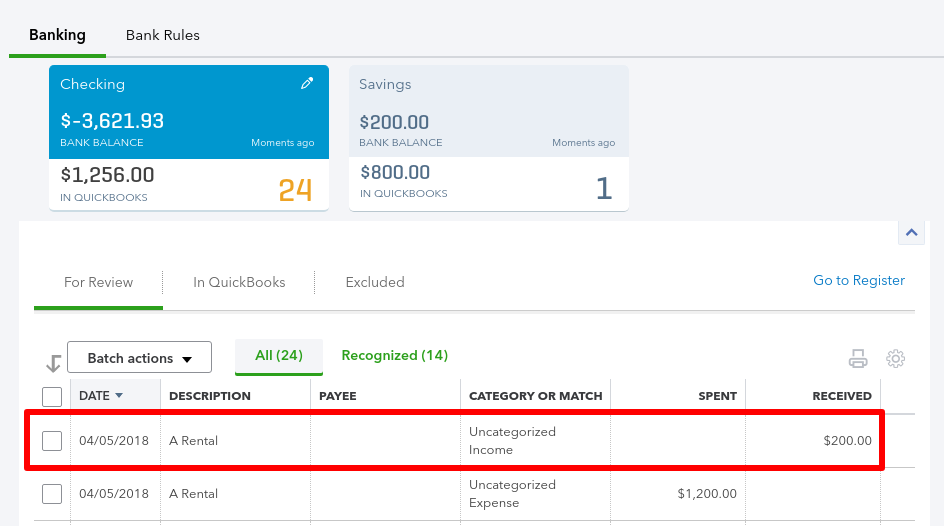

But then, Eric opened the Banking section. There, he saw a money-in transaction for $200.

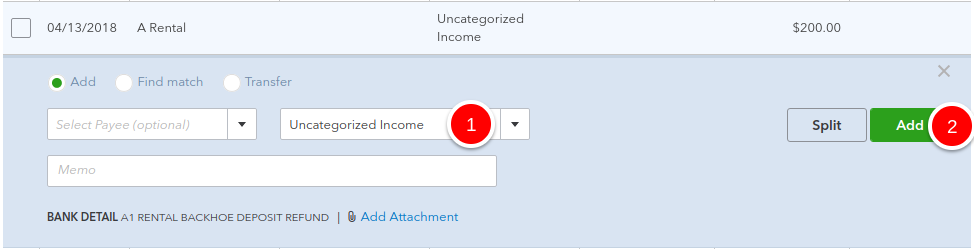

- Eric categorized the $200 money-in transaction to Uncategorized Income, because that is the category to which the transaction automatically defaulted to.

- He then added the money-in transaction to QBO.

Uh oh! Eric did something wrong. When he opens the Bank Deposit window, there will still be a $200 customer payment, and it’s not going anywhere. In fact, the $200 customer payment will continue to sit in the Bank Deposit window until he cleans it up.

In summary, Eric ends up with two errors:

- A Deposit categorized to Uncategorized Income

- An old customer payment in Undeposited Funds.

2. Lack of Training

Eric could have avoided this mess, had he had the proper training. Having a solid foundation in QBO is essential if you want to avoid making a mess.

If you feel like you need to gain a more solid foundation in QBO, then be sure to check out our master class: Mastering QuickBooks Online banking transactions in 7 days. This course will show you how to handle Banking Transactions, including money-in transactions such as customer payments.

Meanwhile, in the next section, I’ll show you how to fix Eric’s improper workflow.

How to clean up Undeposited Funds in QuickBooks Online

Now that I’ve shown you a very common reason for old payments in Undeposited Funds, I’m going to show two methods for cleaning up those old payments, so you can get your books in order.

1. The Remove and Record method for cleaning up Undeposited Funds

We’ll start with removing the incorrectly-entered deposit

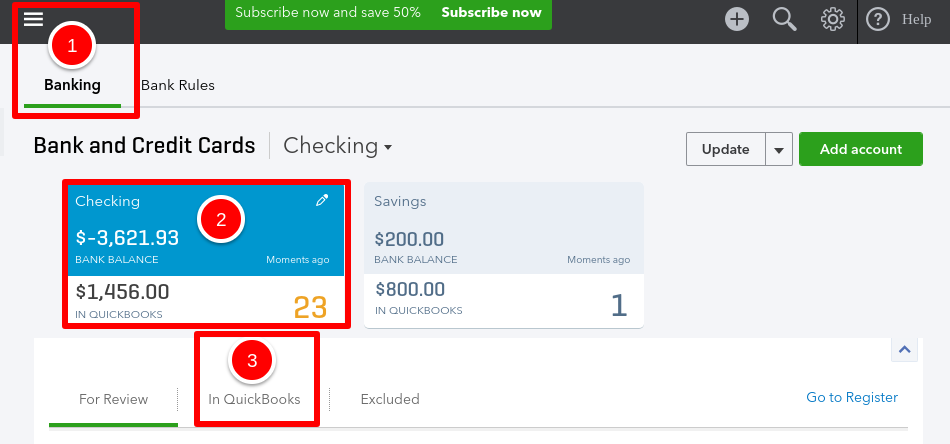

- First, go to the Banking section.

- Select the bank account where the customer payment was intended to be deposited to.

- Then, select the “In QuickBooks” tab.

- Locate the $200 deposit.

- Then, click “UNDO” under the Action column. This will remove the transaction from QBO.

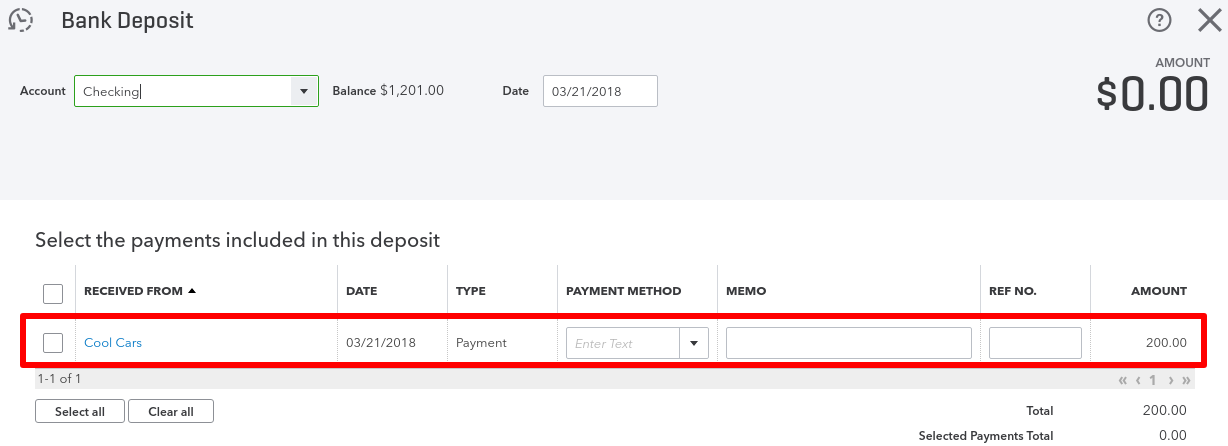

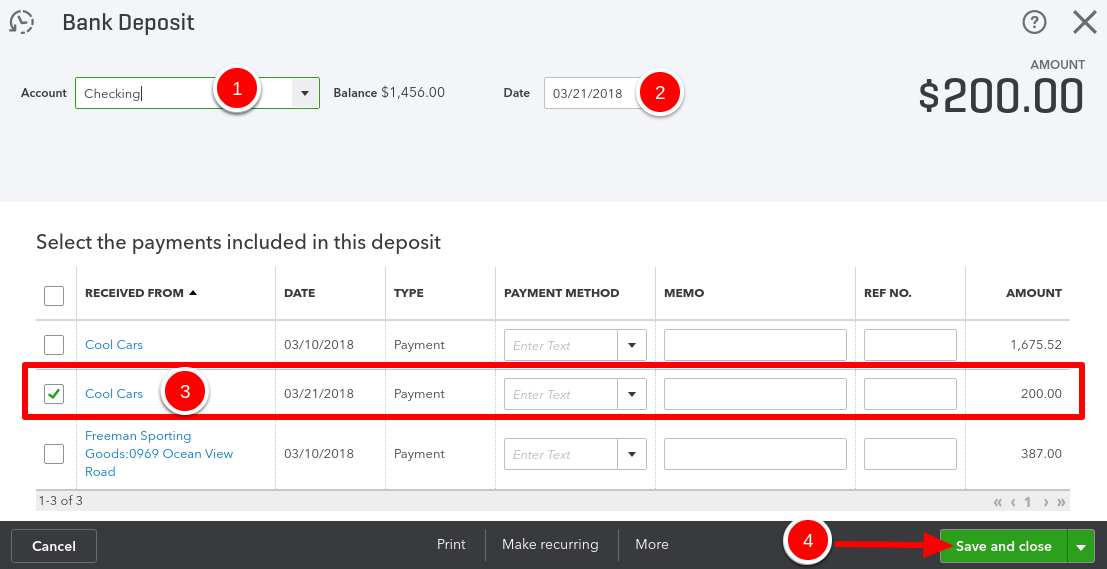

Now, record the deposit in the Bank Deposit window.

- Select the bank account used to make the deposit.

- Enter the date when the customer payment was deposited.

- Select the $200 customer payment from Cool Cars in the “Select Existing Payments” list.

- Select Save and close.

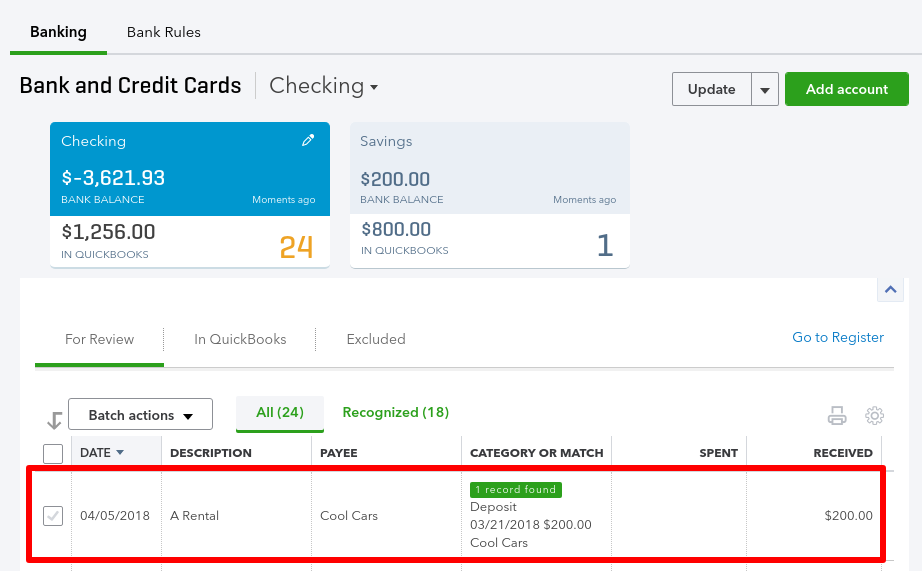

The downloaded transaction will now match in the Banking section to the $200 deposit, which was just recorded.

Simply select Match, and there you go – you’ve fixed the deposit!

Remove and Record Method Pros and Cons:

Pros: This is the most accurate way to clean up payments in Undeposited Funds. It will eliminate any redundant transactions and your sales income will also be correct.

Cons: You must work through each payment one-by-one, so the process will be time-consuming. You must also have documentation to back-up all the transactions you are correcting.

2. The Dummy Bank Account Method for cleaning up Undeposited Funds

Now let’s look at the second method. What do you do when you have multiple old payments sitting in Undeposited Funds, but you don’t remember how they got there? – You clear them out with a Dummy Bank Account.

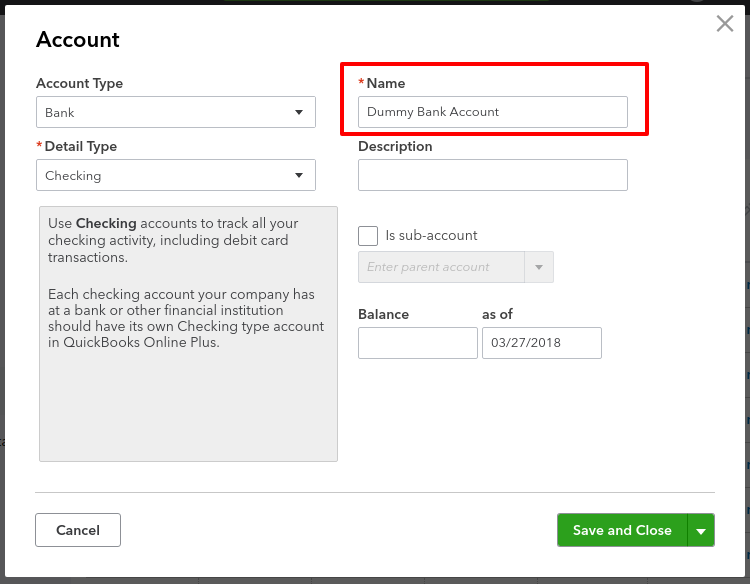

Begin by creating a Dummy Bank Account in the Chart of Accounts (You can name it anything you wish, for example: Smart Bank Account 🙂 ).

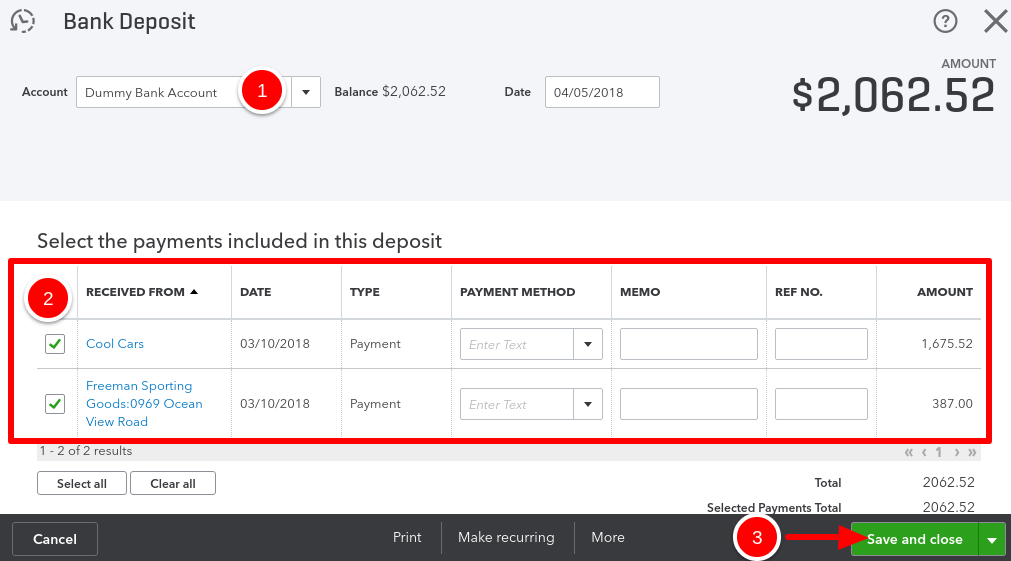

Open the Bank Deposit window

- Select the Dummy Bank Account as the account you will be depositing to.

- Select the customer payments that you want to clear out.

- Then, select Save and Close.

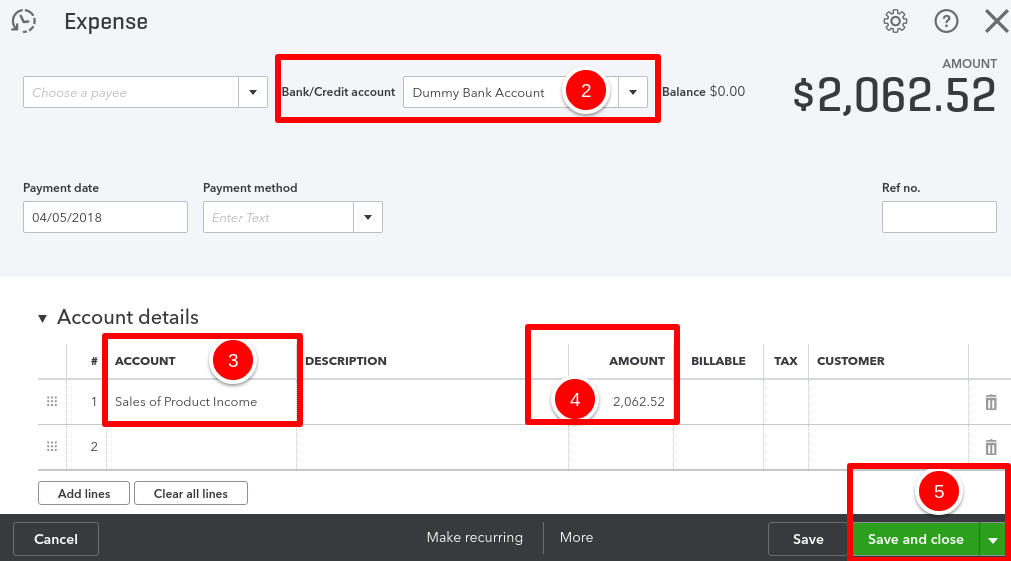

- Next, Create an Expense transaction.

2. Under Bank/Credit account, select the Dummy Bank Account.

3. Under ACCOUNT, select an income account. Try using an income account which you are already using on a regular basis.

4. Under AMOUNT, enter the same dollar amount as the deposit you just recorded (in this case, it was for $2062.52).

5. Finally, select Save and Close.

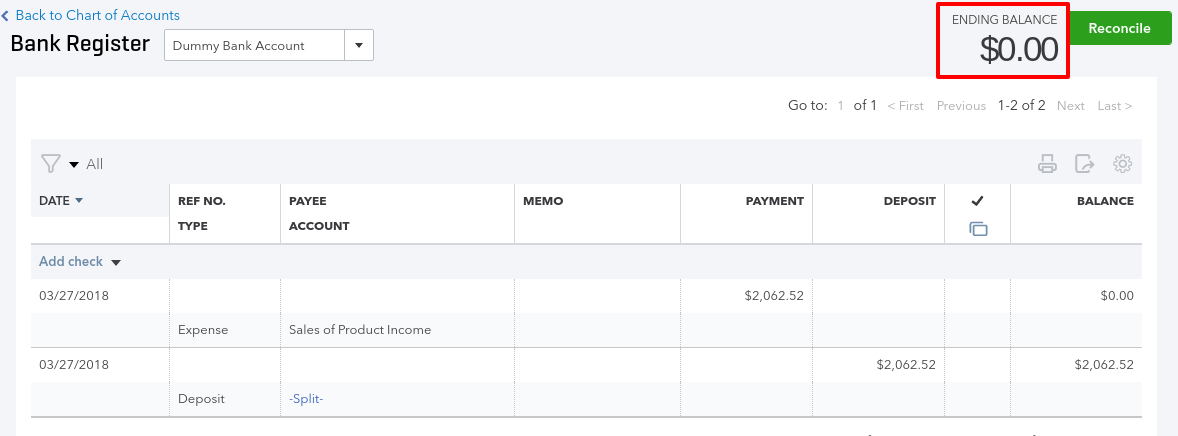

After you’ve recorded the deposit and the expense, verify that the ending balance in the Dummy Bank Account is zero. You can do this by looking at the account register for the Dummy Bank Account in the Chart of Accounts.

Remember, a Dummy Bank Account is not a real bank account, so it should not have an ending balance of any kind.

Dummy Bank Account Method Pros and Cons:

Pros: This is a quick and easy way to clean up old, outstanding payments. You will save a lot of time using this method.

Cons: Although you may save time, you can lose accuracy. Clearing out undeposited customer payments with a Dummy Bank Account will understate income. Understanding income by a potential large amount may have tax implications. Talk to your tax accountant to learn more about these tax implications.

Closing

Eric is relieved to now know two processes for cleaning out these old balances, so he can have cleaner financials. Now that we’ve shown you how to clean up undeposited funds in QuickBooks Online, we hope that you will also apply one of these solutions to clean up any old balances in your undeposited funds account. Remember, if you’d like additional training, check out our master class: Mastering QuickBooks Online banking transactions in 7 days.

Good luck and best wishes!

Hi. For the remove and record method: I have already reconciled, but would like to use this method to clean up my undeposited account. Once I remove it…wouldn’t that throw-off my reconciliation? How would I match the reconcíliated transaction to the undeposited transaction?

Yes, that would throw your reconciliation out of balance. You would need to update your reconciliation.