One fabulous day, Daisy Flowers, business owner extraordinaire, woke up and realized that tax time was upon her. And so, the race to work on her taxes began. Daisy scrambled through her office to find loose receipts, documents, and anything that looked vaguely important. The deadline to file was creeping closer and closer, and Daisy felt nowhere near ready. Finally, out of desperation, she gathered together a stack of papers and crumpled receipts and stuffed them all into a shoebox. Chances are, some of us felt the same way as Daisy as she struggled to get ready for tax time. However, you may be pleased to know that Daisy’s approach is totally unnecessary. Daisy mistakenly believed that she needed a shoebox of documents in order to file her taxes. Today, I’m going to dispel that ‘shoebox myth’, and tell you and Daisy what you really need to do before handing off last year’s books to your tax accountant. Daisy’s race to finish her taxes is on, so let’s ditch the shoebox because I’m going to show you how QuickBooks Online remedies your tax time blues! On your mark, get set, GO!

The shoebox myth

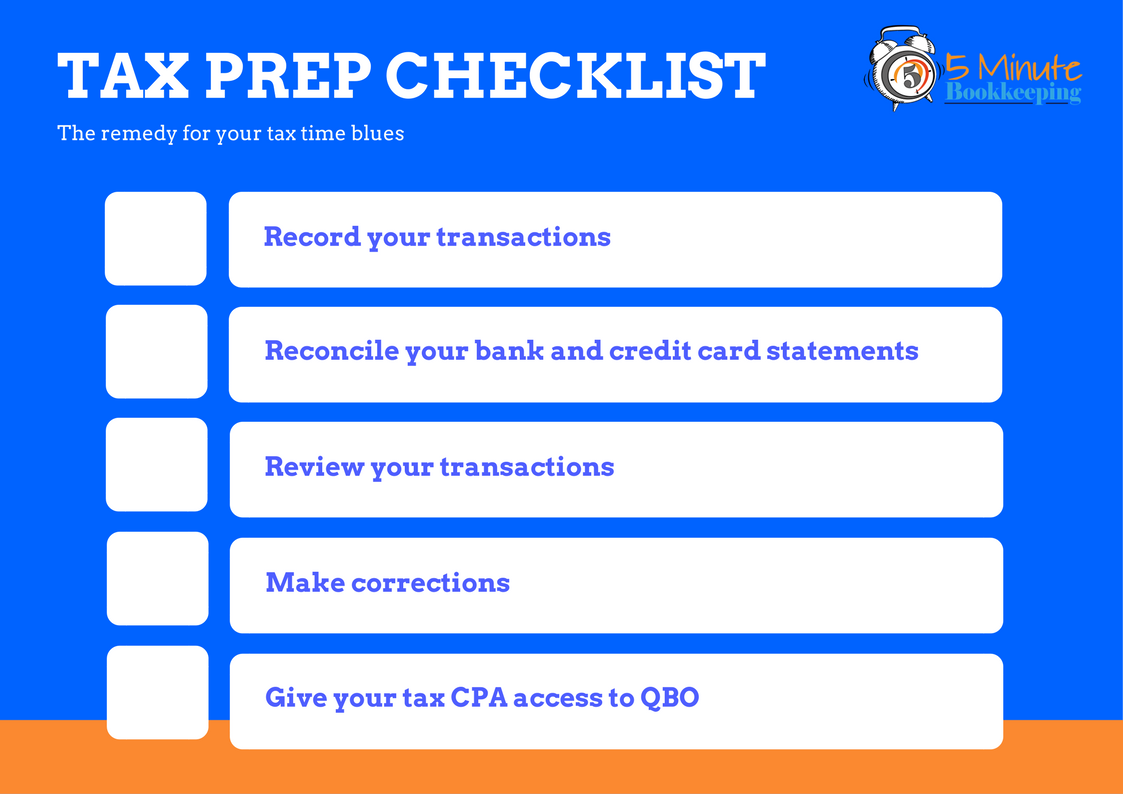

So, what do you and Daisy really need for tax time? Why not start with what you don’t need – a shoebox. The fact of the matter is – tax accountants hate shoeboxes. Who wants to spend hours digging through documents, deciphering faded receipts and scribbled handwriting? What a tax accountant really wants is reports – and these reports come straight from QBO. But, in order to generate these meaningful reports, you and Daisy need to perform the ‘3 Rs’. What are the ‘3 Rs’? Easy! They stand for recoding, reconciling, and reviewing: all three are essential tasks which you and Daisy must do in QBO before handing the work off to a tax accountant.

[bctt tweet=”Recording, reconciling, and reviewing: all three are essential tasks you must do before handing your work off to a tax accountant.” via=”no”]

#1 – Record

Instead of keeping track of transactions with shoeboxes, why not enter them in QBO instead? While there are multiple ways for entering transactions in QBO, I suggest using the QBO banking center. Check out our most popular blog post: Reconciling Accounts in QuickBooks Online, which takes you on a journey through the QBO banking center and shows you how to enter different types of transactions.

Check out our master class: Mastering QuickBooks Online Banking Transactions in 7 Days. This is a master class full of step-by-step video tutorials for working with QBO banking transactions.

Now, if you, like Daisy, forgot to enter a year’s worth of transactions, then don’t panic! We have two blog posts where you and Daisy can learn all about entering a large amount of data in a limited amount of time.

- How to do a full year of bookkeeping when you need it done yesterday – Part 1

- How to do a full year of bookkeeping when you need it done yesterday – part 2

#2 – Reconcile

The purpose of a reconciliation is to verify that each transaction in QBO was in-fact a real transaction. And how do you do this – well, you would compare the transactions in QBO to the transactions on a bank or credit card statement.

Here’s a video showing you how to reconcile bank and credit card transactions in QuickBooks Online.

#3 – Review

After reconciling the bank and credit card accounts, you will need to review. So, why is reviewing so important? Simple! To make sure that transactions are categorized correctly. Imagine finding a credit card expense for a restaurant which was accidentally categorized to office supplies. If transactions are mis-categorized, then the financial reports won’t be meaningful for the tax accountant. Also, business expenses provide valuable tax deductions. You wouldn’t want to miss out on these deductions, would you? To learn more about reviewing transactions in QBO, be sure to check out this blog post: Review Transactions in QuickBooks Online.

Remember to make corrections

Once the ‘3 Rs’ are completed, you may discover some messy transactions which need to be cleaned up. Cleaning up messy transactions isn’t exciting – but it’s a very important step. Fortunately, there are many resources available right here at 5MinuteBookkeeping that that can show you and Daisy how to fix those messy transactions.

Here are some blog posts that go over how to make different types of corrections in QBO:

- How to edit, void, and delete transactions in QuickBooks Online

- Should you start over with QuickBooks Online?

- Why the bank balance does not equal the register balance in QBO

- Unraveling the mysteries of the QuickBooks Online “Undeposited Funds” account

- How to fix expenses entered to the wrong account in QBO

- How to fix duplicated expenses in QuickBooks Online

- How to fix uncategorized income and expenses in QBO

Finally, give your tax accountant, access to QBO.

This step is super quick and easy. Just read How to Invite your Tax Accountant to QuickBooks Online and follow along with the step-by-step instructions on how to give your tax accountant access to your QBO company. If you’ve come this far, then rejoice; you now have 90% of what you need to be ready to file that tax return.

Your last step is to ensure that you have everything recorded, reconciled, and reviewed in QBO first (remember your ‘3 Rs’!). Chances are, your tax accountant is not a QBO expert, so they may not know how to troubleshoot messy transactions in QBO.

Closing

Daisy decided to ditch the shoebox and learn how QuickBooks Online remedies her tax time blues! Did they ever! She was thrilled to know that she would never need a shoebox again. Best of all, she would never have to deal with the stress of shuffling though crumpled ancient documents and wondering, “Do I give this to my tax accountant or not.” With a cup of coffee, Daisy jumped right into QBO and got straight to work on getting all her transactions entered and reconciled. After short race to the finish line. Daisy’s tax accountant was thrilled and told her, “I’ll take it from here Miss Flowers.”