6 Colossal lessons learned from 1099 season

I’m so glad that January is over! January is such a crazy month. We go from visions of sugar plums in December to full-blown panic in January. Why? Because tax season in the USA is upon us! Here are 6 colossal lessons learned from 1099 season. Why not learn from these lessons so that we can prepare throughout the year and make next January a wonderful month. Let’s check it out.

What are 1099’s?

Just in case you don’t know, a 1099 form is a tax form that you provide to certain vendors reporting to them how much you paid them during the past year. The vendor receiving the 1099 form needs it in order to file their income tax return with the IRS.

If you’ve paid $600 or more in compensation to contractors, sub-contractors, freelance workers, or other non-employees in the prior year, you may need to provide them with Form 1099-MISC and report the payments to the IRS. Here is a link to the IRS’s website for all the details on 1099-MISC. You may need a big cup of coffee before you read this! Luckily, there are several simple resources you can use that are much easier to read that the IRS website, as I’ll show you next.

Lesson #1 – Get W-9 forms from all vendors throughout the year

Every January (and even February) I get frantic requests from customers to send them a W-9 form. That’s because they need a W-9 form in order to determine whether they should send me a 1099 form. Here is a link to a W-9 form.

What if the vendor doesn’t give you a W-9 form? Tell them that you can’t pay them until you receive a completed W-9 form. I can assure you that they’ll respond promptly.

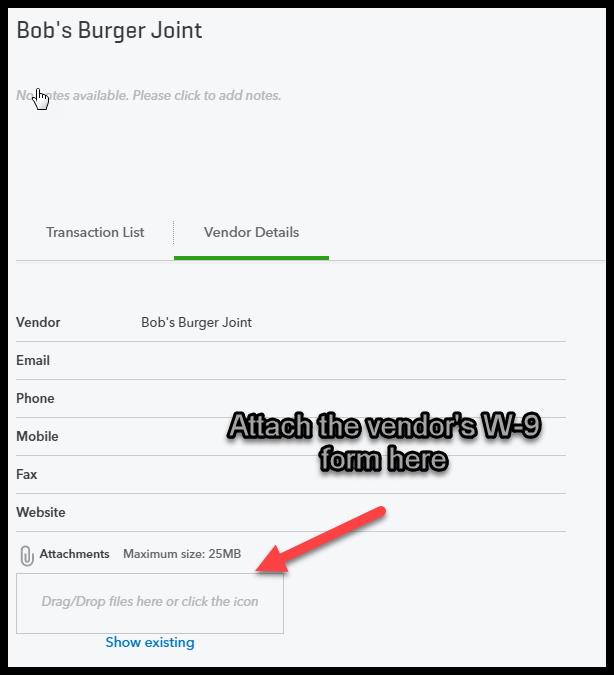

Here’s a tip – you can attach an image of a vendor’s W-9 form directly to the vendor’s file in QuickBooks Online! Simply go to Vendors > click on the vendor’s name > click on the “Vendor details” tab, and scroll down till you see the attachments section.

Here’s another tip – Use an automated W-9 solicitation app like Tax1099.com or Payable. You’ll save hours!

Lesson #2 – File 1099 forms electronically

I used to have a client who would go to Office Depot every year and buy paper 1099 forms. Then he would take hours to print out 1099 forms. And then, he would have to mail all the forms. That is too much work! Did you know that you can actually file 1099 forms electronically? There are so many options for electronically filing 1099 forms like:

- Using QuickBooks Online Plus

- Apps like Tax1099.com or Efile4biz.com

It’s so simple to set up an online account and file electronically. Why not set a reminder for yourself for next year to file your 1099 forms electronically?

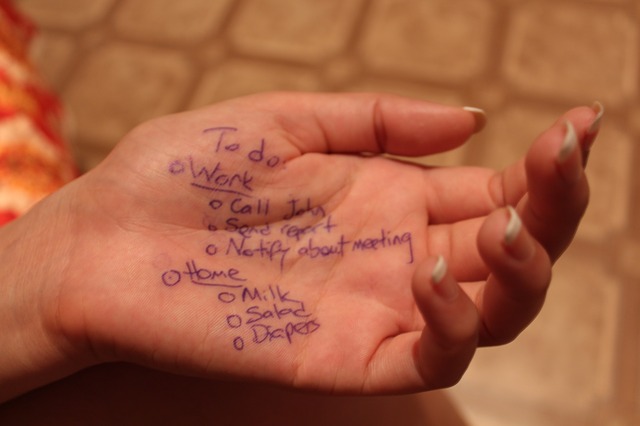

Lesson #3 – Set up a checklist

You may not know this about me but I love checklists! I use checklists all the time especially for tasks that I don’t do very often – like filing 1099 forms. This is a great opportunity for you to make a checklist that you can re-use every year. Here’s an example of some things you may want to include on your checklist:

☑ Get W-9 forms from all vendors

☑ Review vendor list and eliminate duplicate vendor names

☑ Review W-9 forms and determine which vendors should receive 1099 forms

☑ Sign up for 1099 electronic filing app like Tax1099.com or Efile4biz.com

☑ Determine the date of the filing deadline

☑ Prepare 1099 forms

☑ E-file 1099 and 1096 forms by the deadline

[bctt tweet=”Pro-tip: This is a great opportunity for you to make a checklist that you can re-use every year” username=”5MinBookkeeping”]

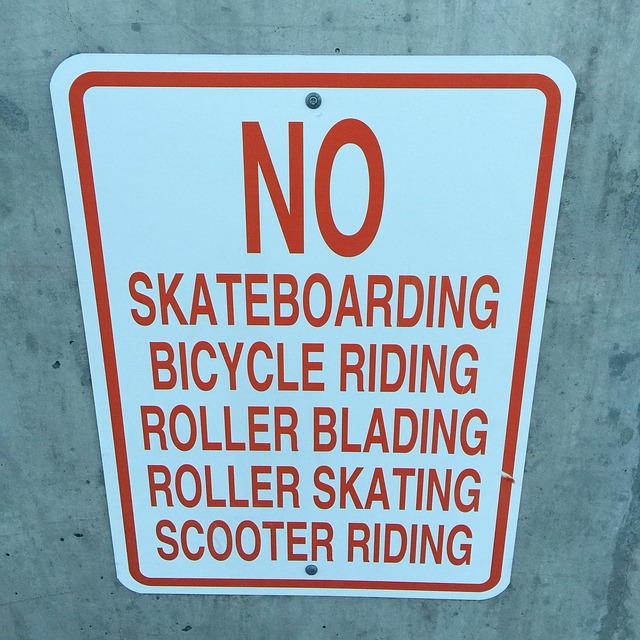

Lesson #4 – Know the rules

Filing 1099 forms can be very tricky. There are a lot of rules that you have to make sure that you follow. This is why you should know the rules before you file any forms. Check out the 1099 instructions from the IRS for all the details. Be sure to familiarize yourself with the basics like:

- Who should you give a Form 1099 to? (Answer – services performed by someone who is not your employee).

- What amounts must you have paid to a non-employee before you are required to send them Form 1099? (Answer – $600 minimum).

- Which types of payments are not required to be reported on Form 1099? (Answer – payments to a corporation – but there are exceptions).

- Are you supposed to report payments to attorneys on form 1099? (Answer – yes, amounts of $600 or more).

If you don’t know the rules or you don’t have time to figure it out – I strongly encourage you to hire an accountant to file 1099 forms for you.

Lesson #5 – Get ready in December – don’t wait until January

This is actually a lesson that we learned recently at my company. It’s best to get ready early. Every year we have typically waited until January to get ready for 1099’s. January can get really crazy around here, so, we decided to get ready in December. So far, I can tell you that starting early has been the secret to a very successful 1099 season for us. It has made a HUGE difference. No last minute 1099’s around here for us!

Lesson #6 – Know the filing deadline

The IRS decided to change the deadlines for filing 1099 forms and essentially shortened the filing season by one month. That meant that there was absolutely no time to waste. Be aware of filing deadlines so that you don’t incur any penalties. Here is a link to the IRS website listing all of the potential penalties you can incur for filing forms late.

Closing

Now that 1099 season is over, why not apply these 6 colossal lessons learned from 1099 season to make next January stress-free? Leave a comment and let me know how you made it through your 1099 season. Have a great week!